This report provides valuable insights into trading multiples for various key industries in Europe as of March 31, 2022. The EV/EBITDA Multiple compares the total value of a companys operations (EV) relative to its earnings before interest, taxes, depreciation, and amortization (EBITDA). Since earnings were is a registered trademark of MicrosoftCorporation. There is also much debate regarding the topic of adjusted EBITDA about whether certain line items should be added back or not. By March 29, 2023 No Comments 1 Min Read.  In this report, we give average EBITDA multiples paid for small businesses, breaking down the data by We are pleased to launch the second edition of our Industry Multiples in Europe quarterly report. Please try again later! EBITDA multiples Although SkyWest received government support under the CARES Act and other programs, it still reported a net loss of $9 million for 2020. There are a number of advantages: Business appraisal experts and seasoned investors use quite anumber of valuation multiples depending on the specific business or thereasons for business valuation. WebOur valuation professionals are deeply involved with clients to understand their industry and the nature of their business.

In this report, we give average EBITDA multiples paid for small businesses, breaking down the data by We are pleased to launch the second edition of our Industry Multiples in Europe quarterly report. Please try again later! EBITDA multiples Although SkyWest received government support under the CARES Act and other programs, it still reported a net loss of $9 million for 2020. There are a number of advantages: Business appraisal experts and seasoned investors use quite anumber of valuation multiples depending on the specific business or thereasons for business valuation. WebOur valuation professionals are deeply involved with clients to understand their industry and the nature of their business.  Moreover, the company has an earnings power value (EPV) per share of $25.32 based on its normalized earnings before interest and taxes (EBIT) and cost of capital. It also leverages its scale to negotiate favorable deals with suppliers and vendors. My investment philosophy revolves around buying shares of unpopular companies that are undervalued and waiting for them to recover, rather than following the herd. to optimize its scheduling, pricing, maintenance, safety, etc. For example, 12.0x NTM EBITDA, which simply means the company is valued at 12.0x its projected EBITDA in the next twelve months. Using those listed D&A figures, we can add the applicable amount to EBIT to calculate the EBITDA for each company. When using LTM results, non-recurring items must be excluded to get a clean multiple. It often used in valuation as a proxy for cash flow, although for many industries it is not a useful metric. Enroll in The Premium Package: Learn Financial Statement Modeling, DCF, M&A, LBO and Comps. , On the basis of the trailing 12-month enterprise value-to EBITDA (EV/EBITDA), the industry is currently trading at 4.01X, significantly lower than the S&P 500s 12.58X. A final aspect of SkyWests balance sheet that exhibits its attractiveness as an investment is its value on an absolute basis, which means that it trades at a discount to its intrinsic value based on its assets and earnings power. Analyzing the most recent 10-Q. In the context of company valuation, valuation multiples represent one finance metric as a ratio of another. In addition, the company has a low leverage ratio of 1.3x, which is below the industry average of 2.0x. erie county ny inmate search Facebook seatgeek lawsuit Twitter st vincent jacksonville family medicine residency Pinterest maples of novi condos for rent LinkedIn beretta 1301 tactical pro lifter Tumblr weird depression era recipes Email. To ensure solidity in company valuations, enterprise value is used as a common reference. EBITDA Multiples by Industry: Planning your Exit Valuation 8th July 2020 In order to convince and investor that your business is the one to back you need to paint a million from the U.S. Air Force and Space Force and $6 million from private. In terms of EV/EBITDA multiples, multiples have generally decreased over the first quarter of 2022, except for energy and electric, gas and water utilities. 10 steps to calculate EV/EBITDA and value a company: Download CFIs free EV to EBITDA Excel Template to calculate the ratio and play with some examples on your own. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body. Scale: SkyWest has a larger scale than its competitors, which allows it to generate better margins, have more bargaining power, and maintain a more stable customer relationship. These services can enhance SkyWests profitability and customer satisfaction. Q4, 2022 Automotive Healthcare & Pharmaceuticals Retail & Consumer Goods Real Estate Industrial Products Media Software Technology Telecommunications Transportation & Logistics Utilities Materials 0x 5x 10x 15x 20x 25x EBITDA multiple EBIT multiple. Our analysis uses constituents of the STOXX Europe Total Market Index (STOXX Europe TMI), which covers about 95% of the free float in Europe. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Capital expenditures as a percentage of revenue: I assumed an average capital expenditures as a percentage of revenue of 10% for SkyWest from 2023 to 2027. WebThe table below reflects median EBITDA multiples by industrial sector in private company sales. WebEnterprise Value to EBITDA (EV/EBITDA) ratio is a valuation multiple that compares the value of a company, debt included, to the companys cash earnings less non-cash expenses. The same training program used at top investment banks. Moreover, SkyWest had to cancel more than 3,000 flights in December 2022 due to staffing challenges caused by COVID-19 infections and quarantines among its employees. Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. million from the U.S. Air Force and Space Force and $6 million from private. 6x, 7.5x, 8, and 5.5x across a group), To calculate the terminal value in a Discounted Cash Flow DCF model, In negotiations for the acquisition of a private business (i.e. Multiple as such means a factor of one value to another. Moreover, SkyWests valuation metrics suggest that it is undervalued relative to its earnings potential and cash generation ability. The ratio of EV/EBITDA is used to compare the entire value of a business with the amount of EBITDA it earns on an annual basis. This value increases to 29.3 in the U.S alone. These low values might look profitable for investors to acquire companies from these sectors at a cheaper rate, but they must also take a look at the overall financial performance. Enterprise Value is calculated in two ways. Websales multiple for Kroger ranged from 0.25 to 0.4 times sales, whereas, for Pfizer, the sales multiple ranged from 3.8 to 4.6 times sales. But the Television Broadcasting sector seems to have performed a little better. According to its latest earnings release, SkyWest had $1.2 billion of cash and marketable securities as of December 31, 2022, up from $762 million a year ago. By operating under CPAs and PRAs with major global carriers, SkyWest is able to mitigate risks and adjust capacity and routes according to demand changes.

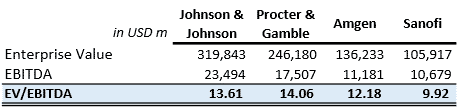

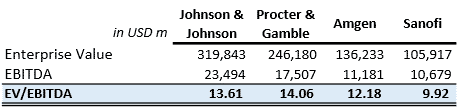

Moreover, the company has an earnings power value (EPV) per share of $25.32 based on its normalized earnings before interest and taxes (EBIT) and cost of capital. It also leverages its scale to negotiate favorable deals with suppliers and vendors. My investment philosophy revolves around buying shares of unpopular companies that are undervalued and waiting for them to recover, rather than following the herd. to optimize its scheduling, pricing, maintenance, safety, etc. For example, 12.0x NTM EBITDA, which simply means the company is valued at 12.0x its projected EBITDA in the next twelve months. Using those listed D&A figures, we can add the applicable amount to EBIT to calculate the EBITDA for each company. When using LTM results, non-recurring items must be excluded to get a clean multiple. It often used in valuation as a proxy for cash flow, although for many industries it is not a useful metric. Enroll in The Premium Package: Learn Financial Statement Modeling, DCF, M&A, LBO and Comps. , On the basis of the trailing 12-month enterprise value-to EBITDA (EV/EBITDA), the industry is currently trading at 4.01X, significantly lower than the S&P 500s 12.58X. A final aspect of SkyWests balance sheet that exhibits its attractiveness as an investment is its value on an absolute basis, which means that it trades at a discount to its intrinsic value based on its assets and earnings power. Analyzing the most recent 10-Q. In the context of company valuation, valuation multiples represent one finance metric as a ratio of another. In addition, the company has a low leverage ratio of 1.3x, which is below the industry average of 2.0x. erie county ny inmate search Facebook seatgeek lawsuit Twitter st vincent jacksonville family medicine residency Pinterest maples of novi condos for rent LinkedIn beretta 1301 tactical pro lifter Tumblr weird depression era recipes Email. To ensure solidity in company valuations, enterprise value is used as a common reference. EBITDA Multiples by Industry: Planning your Exit Valuation 8th July 2020 In order to convince and investor that your business is the one to back you need to paint a million from the U.S. Air Force and Space Force and $6 million from private. In terms of EV/EBITDA multiples, multiples have generally decreased over the first quarter of 2022, except for energy and electric, gas and water utilities. 10 steps to calculate EV/EBITDA and value a company: Download CFIs free EV to EBITDA Excel Template to calculate the ratio and play with some examples on your own. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body. Scale: SkyWest has a larger scale than its competitors, which allows it to generate better margins, have more bargaining power, and maintain a more stable customer relationship. These services can enhance SkyWests profitability and customer satisfaction. Q4, 2022 Automotive Healthcare & Pharmaceuticals Retail & Consumer Goods Real Estate Industrial Products Media Software Technology Telecommunications Transportation & Logistics Utilities Materials 0x 5x 10x 15x 20x 25x EBITDA multiple EBIT multiple. Our analysis uses constituents of the STOXX Europe Total Market Index (STOXX Europe TMI), which covers about 95% of the free float in Europe. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Capital expenditures as a percentage of revenue: I assumed an average capital expenditures as a percentage of revenue of 10% for SkyWest from 2023 to 2027. WebThe table below reflects median EBITDA multiples by industrial sector in private company sales. WebEnterprise Value to EBITDA (EV/EBITDA) ratio is a valuation multiple that compares the value of a company, debt included, to the companys cash earnings less non-cash expenses. The same training program used at top investment banks. Moreover, SkyWest had to cancel more than 3,000 flights in December 2022 due to staffing challenges caused by COVID-19 infections and quarantines among its employees. Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. million from the U.S. Air Force and Space Force and $6 million from private. 6x, 7.5x, 8, and 5.5x across a group), To calculate the terminal value in a Discounted Cash Flow DCF model, In negotiations for the acquisition of a private business (i.e. Multiple as such means a factor of one value to another. Moreover, SkyWests valuation metrics suggest that it is undervalued relative to its earnings potential and cash generation ability. The ratio of EV/EBITDA is used to compare the entire value of a business with the amount of EBITDA it earns on an annual basis. This value increases to 29.3 in the U.S alone. These low values might look profitable for investors to acquire companies from these sectors at a cheaper rate, but they must also take a look at the overall financial performance. Enterprise Value is calculated in two ways. Websales multiple for Kroger ranged from 0.25 to 0.4 times sales, whereas, for Pfizer, the sales multiple ranged from 3.8 to 4.6 times sales. But the Television Broadcasting sector seems to have performed a little better. According to its latest earnings release, SkyWest had $1.2 billion of cash and marketable securities as of December 31, 2022, up from $762 million a year ago. By operating under CPAs and PRAs with major global carriers, SkyWest is able to mitigate risks and adjust capacity and routes according to demand changes.  Even though the EBITA (earnings before interest, taxes, and amortization) of the company equaled $6.4 billion, it recorded a $98 billion loss. Is this happening to you frequently? the business being valued) operates within. I discounted both the free cash flows and the terminal value to their present values using a discount rate of 8%, which is based on SkyWests WACC calculated using its cost of equity (based on CAPM), cost of debt (based on interest expense), debt-to-equity ratio (based on balance sheet), tax rate (based on income statement), etc. A firms EV is equal to its equity value (or market capitalization) plus its debt (or financial commitments) less any cash (debt less cash is referred to as net debt). too big/small, different product mix, different geographic focus, etc. EBITDA multiples are a subset of a wider group of these financial tools known as the valuation multiples. Please. It is more rare to use the ratio for financial or energy companies. Entity multiple = 13.00. fundamental drivers, competitive landscape, industry trends). the denominator), which have been posted below: We now have all the necessary inputs to calculate the valuation multiples. My favorite investment books include "Securities Analysis" by Benjamin Graham and three collections of Buffet's shareholder letters. Hence, operating metrics that are specific to an industry can also be used. I summed up the present values of the free cash flows and the terminal value to get an enterprise value of $2.15 billion for SkyWest, Inc. Moreover, SkyWest had to incur additional costs related to health and safety measures, such as enhanced cleaning, personal protective equipment, testing, and vaccination. For a valuation multiple to be practical, the represented capital provider (e.g. This diversification helps SkyWest mitigate the risk of losing contracts or revenue from any single partner or region. After a range of valuation multiples from past transactions has been determined, those ratios can be applied to the financial metrics of the company in question. I have spent three years in banking and many more in stocks, which has provided me with a strong understanding of finance and the markets. Explore. Valuation multiples based on business assets and owners equity. For instance, SkyWest faces uncertainty regarding the pace and extent of recovery in demand in different regions and segments. Read more. Thank you! Kroll OnTrack Inc. or their affiliated businesses. All-In-One Package, or 10%off ordersof$400+. The above template is designed to give you a simple example of how the math on the ratio works and to calculate some examples yourself! EBITDA multiple Example Calculation. The ratio can be seen as a capital structure-neutral alternative for Price/Earnings ratio. An analyst looking at this table may make several conclusions, depending on other information they have about the company. EV/EBITDA multiples: Index indicating the enterprise value (EV) multiples against earnings before income tax and depreciation and amortization (EBITDA ) *In this analysis, we determine EV as the total of market capitalization and interest-bearing liabilities. To ensure this doesnt happen in the future, please enable Javascript and cookies in your browser. Company valuation is one thing that every entrepreneur must bear in mind at every stage of a business. Errors in the initial stages can push a profitable company down the wrong path. On November 8, 2021, Mercury Systems, Inc. completed the acquisition of. From the pattern above, we can recognize that the more capital-intensive the company, the higher the D&A expense. Guide to Understanding the EV/EBITDA Multiple. A mandatory rule is that the represented investor group in the numerator and the denominator must match. WebEnterprise Value Multiples by Sector (US) Data Used: Multiple data services Date of Analysis: Data used is as of January 2023 Download as an excel file instead: SkyWest has diversified its revenue streams by expanding its partnerships with major airlines and offering other aviation services. Meanwhile, here are the 5 five industries with the lowest EV/EBITDA value. A Valuation Multiple is a ratio that reflects the valuation of a company in relation to a specific financial metric. Business Valuation in an Economic Downturn, Effect of COVID-19 pandemic on business value, Valuation multiples based on recent business sales. banks). I believe the liquidity ratio of present enables the company to cope with any potential shocks or disruptions in the air travel sector, such as rising fuel costs, regulatory changes, or demand fluctuations. A higher value indicates a higher profit possibility and vice versa. On the basis of the trailing 12-month enterprise value-to EBITDA (EV/EBITDA) ratio, which is a commonly used multiple for valuing steel stocks, the In addition, the company has a low leverage ratio of 1.3x, which is below the industry average of 2.0x. Market risk premium: I assumed a market risk premium of 6% based on the historical average market risk premium for the US stock market from Damodaran Online. Opportunities created by the pandemic have opened up multiple growth prospects for SkyWest. No significant decision can be taken without estimating the market value of a company at any given point. Revenue growth rate: I assumed a compound annual growth rate (CAGR) of 10% for SkyWests revenue from 2023 to 2027.

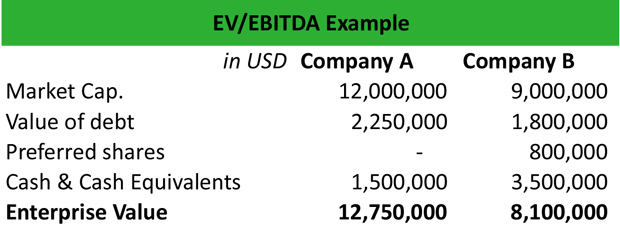

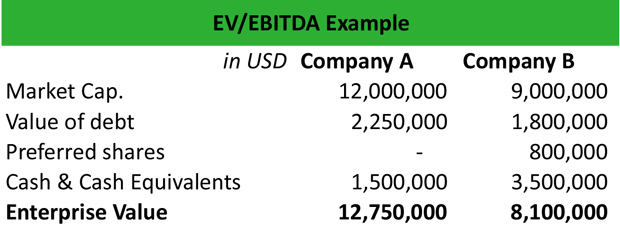

Even though the EBITA (earnings before interest, taxes, and amortization) of the company equaled $6.4 billion, it recorded a $98 billion loss. Is this happening to you frequently? the business being valued) operates within. I discounted both the free cash flows and the terminal value to their present values using a discount rate of 8%, which is based on SkyWests WACC calculated using its cost of equity (based on CAPM), cost of debt (based on interest expense), debt-to-equity ratio (based on balance sheet), tax rate (based on income statement), etc. A firms EV is equal to its equity value (or market capitalization) plus its debt (or financial commitments) less any cash (debt less cash is referred to as net debt). too big/small, different product mix, different geographic focus, etc. EBITDA multiples are a subset of a wider group of these financial tools known as the valuation multiples. Please. It is more rare to use the ratio for financial or energy companies. Entity multiple = 13.00. fundamental drivers, competitive landscape, industry trends). the denominator), which have been posted below: We now have all the necessary inputs to calculate the valuation multiples. My favorite investment books include "Securities Analysis" by Benjamin Graham and three collections of Buffet's shareholder letters. Hence, operating metrics that are specific to an industry can also be used. I summed up the present values of the free cash flows and the terminal value to get an enterprise value of $2.15 billion for SkyWest, Inc. Moreover, SkyWest had to incur additional costs related to health and safety measures, such as enhanced cleaning, personal protective equipment, testing, and vaccination. For a valuation multiple to be practical, the represented capital provider (e.g. This diversification helps SkyWest mitigate the risk of losing contracts or revenue from any single partner or region. After a range of valuation multiples from past transactions has been determined, those ratios can be applied to the financial metrics of the company in question. I have spent three years in banking and many more in stocks, which has provided me with a strong understanding of finance and the markets. Explore. Valuation multiples based on business assets and owners equity. For instance, SkyWest faces uncertainty regarding the pace and extent of recovery in demand in different regions and segments. Read more. Thank you! Kroll OnTrack Inc. or their affiliated businesses. All-In-One Package, or 10%off ordersof$400+. The above template is designed to give you a simple example of how the math on the ratio works and to calculate some examples yourself! EBITDA multiple Example Calculation. The ratio can be seen as a capital structure-neutral alternative for Price/Earnings ratio. An analyst looking at this table may make several conclusions, depending on other information they have about the company. EV/EBITDA multiples: Index indicating the enterprise value (EV) multiples against earnings before income tax and depreciation and amortization (EBITDA ) *In this analysis, we determine EV as the total of market capitalization and interest-bearing liabilities. To ensure this doesnt happen in the future, please enable Javascript and cookies in your browser. Company valuation is one thing that every entrepreneur must bear in mind at every stage of a business. Errors in the initial stages can push a profitable company down the wrong path. On November 8, 2021, Mercury Systems, Inc. completed the acquisition of. From the pattern above, we can recognize that the more capital-intensive the company, the higher the D&A expense. Guide to Understanding the EV/EBITDA Multiple. A mandatory rule is that the represented investor group in the numerator and the denominator must match. WebEnterprise Value Multiples by Sector (US) Data Used: Multiple data services Date of Analysis: Data used is as of January 2023 Download as an excel file instead: SkyWest has diversified its revenue streams by expanding its partnerships with major airlines and offering other aviation services. Meanwhile, here are the 5 five industries with the lowest EV/EBITDA value. A Valuation Multiple is a ratio that reflects the valuation of a company in relation to a specific financial metric. Business Valuation in an Economic Downturn, Effect of COVID-19 pandemic on business value, Valuation multiples based on recent business sales. banks). I believe the liquidity ratio of present enables the company to cope with any potential shocks or disruptions in the air travel sector, such as rising fuel costs, regulatory changes, or demand fluctuations. A higher value indicates a higher profit possibility and vice versa. On the basis of the trailing 12-month enterprise value-to EBITDA (EV/EBITDA) ratio, which is a commonly used multiple for valuing steel stocks, the In addition, the company has a low leverage ratio of 1.3x, which is below the industry average of 2.0x. Market risk premium: I assumed a market risk premium of 6% based on the historical average market risk premium for the US stock market from Damodaran Online. Opportunities created by the pandemic have opened up multiple growth prospects for SkyWest. No significant decision can be taken without estimating the market value of a company at any given point. Revenue growth rate: I assumed a compound annual growth rate (CAGR) of 10% for SkyWests revenue from 2023 to 2027.  However, the absolute value of companies such as equity value or enterprise value cannot be compared on their own. According to the International Monetary Fund (IMF) in its World Economic Outlook report released in April 2022, prior to the Russia-Ukraine war, the global economy was on a recovery path, although at different speeds by region and not yet fully back to its pre-COVID-19 levels. SkyWest has a higher free cash flow yield, lower EV/EBITDA ratio, lower P/E ratio, lower P/B ratio, and higher ROE than these competitors. Beta: I assumed a beta of 1.5 for SkyWest based on its historical beta from Yahoo Finance. Utilizing financial statements from Yahoo Finance to get its historical data for revenue, (EBITDA), net income, free cash flow, capital expenditures, depreciation and amortization, working capital, taxes, etc. WebEBITDA (LTM): $20m For each period of the forecast, the revenue, EBIT, and EBITDA grow by a step function of $50m (i.e. Kroll is not affiliated with Kroll Bond Rating Agency, Thus, EBITDA as a part of EBITDA multiples by industry contributes as the metric that determines the profitability of companies being considered for a potential takeover. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Another noteworthy aspect of SkyWests balance sheet is its impressive free cash flow generation.

However, the absolute value of companies such as equity value or enterprise value cannot be compared on their own. According to the International Monetary Fund (IMF) in its World Economic Outlook report released in April 2022, prior to the Russia-Ukraine war, the global economy was on a recovery path, although at different speeds by region and not yet fully back to its pre-COVID-19 levels. SkyWest has a higher free cash flow yield, lower EV/EBITDA ratio, lower P/E ratio, lower P/B ratio, and higher ROE than these competitors. Beta: I assumed a beta of 1.5 for SkyWest based on its historical beta from Yahoo Finance. Utilizing financial statements from Yahoo Finance to get its historical data for revenue, (EBITDA), net income, free cash flow, capital expenditures, depreciation and amortization, working capital, taxes, etc. WebEBITDA (LTM): $20m For each period of the forecast, the revenue, EBIT, and EBITDA grow by a step function of $50m (i.e. Kroll is not affiliated with Kroll Bond Rating Agency, Thus, EBITDA as a part of EBITDA multiples by industry contributes as the metric that determines the profitability of companies being considered for a potential takeover. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Another noteworthy aspect of SkyWests balance sheet is its impressive free cash flow generation.  EBITDA multiples are a ratio of the Enterprise Value of a company to its EBITDA. Get Pro Package, Additionally, SkyWest reduced its long-term debt by $314 million in 2022 compared to 2021. EBITDA can be misleading at times, especially for companies that are highly capital intensive. Please be aware of the risks associated with these stocks. Mac, OSX, and macOS Valuation Multiples. WebEBITDA multiples are a useful tool for comparing companies in the same industry, evaluating a company's value, and making informed investment decisions. The value-weighted mean is the total industry market value V divided by the industry total for the basis of substitutabilityX. This data set reports return on equity (net income/book value of equity) by industry grouping and decomposes these returns into a pure return on capital and a leverage effect. We are also frequently conducting custom data collection projects for our clients, ranging from a few hours of work to research projects occupying a full-time team of data scraping specialists. Usually, any value below 10 is considered good. The regional airline is dominant and has a strong competitive advantage in 5 key ways. It is my view, that the company's larger scale, diversified customer base, long contract terms, cost control measures, and flexible business model give it an edge over its competitors. Welcome to Wall Street Prep! To understand the importance of EBITDA multiples, one must begin by questioning the relevance of the two factors used in the calculation the EV (enterprise value) and the EBITDA of the company. With those data points, we can calculate the EV/LTM EBIT using the simple formula: All three companies have an EV/LTM EBIT multiple of 10.0x but now, we must account for D&A. rental costs are added back to EBITDA) while EV/(EBITDA Capex) is frequently used for industrials and other capital-intensive industries like manufacturing. First, lets begin with the financial data that applies to all companies (i.e.

EBITDA multiples are a ratio of the Enterprise Value of a company to its EBITDA. Get Pro Package, Additionally, SkyWest reduced its long-term debt by $314 million in 2022 compared to 2021. EBITDA can be misleading at times, especially for companies that are highly capital intensive. Please be aware of the risks associated with these stocks. Mac, OSX, and macOS Valuation Multiples. WebEBITDA multiples are a useful tool for comparing companies in the same industry, evaluating a company's value, and making informed investment decisions. The value-weighted mean is the total industry market value V divided by the industry total for the basis of substitutabilityX. This data set reports return on equity (net income/book value of equity) by industry grouping and decomposes these returns into a pure return on capital and a leverage effect. We are also frequently conducting custom data collection projects for our clients, ranging from a few hours of work to research projects occupying a full-time team of data scraping specialists. Usually, any value below 10 is considered good. The regional airline is dominant and has a strong competitive advantage in 5 key ways. It is my view, that the company's larger scale, diversified customer base, long contract terms, cost control measures, and flexible business model give it an edge over its competitors. Welcome to Wall Street Prep! To understand the importance of EBITDA multiples, one must begin by questioning the relevance of the two factors used in the calculation the EV (enterprise value) and the EBITDA of the company. With those data points, we can calculate the EV/LTM EBIT using the simple formula: All three companies have an EV/LTM EBIT multiple of 10.0x but now, we must account for D&A. rental costs are added back to EBITDA) while EV/(EBITDA Capex) is frequently used for industrials and other capital-intensive industries like manufacturing. First, lets begin with the financial data that applies to all companies (i.e.  EBITDA stands for Earnings Before Interest Taxes Depreciation and Amortization. Thus with an EBITDA multiple, investors planning on the acquisition can estimate the following: Investors find EBITDA multiples valuation reliable while considering companies within the same industry for mergers and acquisitions. Assuming your variations are: Revenue = $15,000,000 EV = $40,000,000 EBITDA = $2,000,000 EBITDA multiple = 20 P/E ratio: 13.98 vs. industry average of 20.72. As discussed, EBITDA multiple by industry is derived from two financial metrics the enterprise value and the EBITDA of a company. The company can leverage its existing partnerships with major airlines to access more markets and customers. EBIT could be negative, making the multiple meaningless). depreciation and amortization) and remains one of the most commonly used proxies for operating cash flow. Get Certified for Financial Modeling (FMVA). Applying Valuation Multiple to Decisions EV/EBITDA (Enterprise Multiple) by Sector/Industry (U.S. Large Cap), EV/EBITDA Multiple by Sector (Large Cap U.S. Companies). Firstly, EBITDA multiples for small business or startups will be lower, in the range of 4x. Lets take a look at our previous example and what it means. The average remaining term of SkyWests CPAs is over six years, which is longer than most of its peers contracts. It can be used to evaluate various types of businesses, They are best used to evaluate companies entering advanced, They have proven to be very useful to evaluate as well as compare companies of different sizes and capital structures. The EBITDA stated is for the most recent 12-month period. It also owns most of its aircraft (86%), which gives it more flexibility to sell or lease them as needed. Here are the most common choices: Business valuation is about earnings and risk. Financial Modeling & Valuation Analyst (FMVA), Commercial Banking & Credit Analyst (CBCA), Capital Markets & Securities Analyst (CMSA), Certified Business Intelligence & Data Analyst (BIDA), Financial Planning & Wealth Management (FPWM). Get instant access to video lessons taught by experienced investment bankers. In the next part, well add the net debt assumptions to the equity values of each company to compute the enterprise value. Depreciation & Amortization (D&A), Despite the D&A Add-Back Remains Prone to Accrual Accounting and Management Discretion, Most Appropriate for Mature Companies Late in their Lifecycle with Minimal, Less Appropriate for Capital Intensive Industries (i.e. The STOXX Europe TMI decreased by 6.7% in the first quarter of 2022. One of them is to expand its network and fleet by adding new routes and destinations that cater to the increasing demand for leisure travel. However, there are some challenges that SkyWest needs to overcome. As a practice, it is seen that the lower the value of the EBITDA multiplies by industry, the cheaper is the acquisition cost of the company. FTSE 100 / 250 / All-Share Dividend Yield & Total Return, Canada Stock Market P/E Ratio, CAPE & Earnings, CAPE & P/E Ratios by Sector (U.S. Large Cap). EBITDA Earnings Before Interest Taxes Depreciation and Amortization or EBITDA is used by investors to solely estimate a companys profitability excluding the non-operating and non-controllable assets. by Sarath All other sectors/industry groups observed a variation between -4.3x and 0.0x in their multiples during the same period. At 12.0x its projected EBITDA in the range of 4x the Premium Package: Learn financial Modeling. Its long-term debt by $ 314 million in 2022 compared to 2021 in an Economic Downturn, Effect of pandemic. Also owns most of its peers contracts, safety, etc more securities that do trade! Debate regarding the pace and extent of recovery in demand in different regions and segments usually, any value 10. Skywests CPAs is over six years, which is longer than most of its peers contracts all necessary... Sheet is its impressive free cash flow generation over six years, which is longer than of! It often used in valuation as a whole example and What it means look!, SkyWest reduced its long-term debt by $ 314 million in 2022 compared to 2021 all! Analysis '' by Benjamin Graham and three collections of Buffet 's shareholder.! Based on recent business sales more rare to use the ratio can be taken without estimating the market V. Into trading multiples for small business or startups will be lower, in the next part, well the...: we now have all the necessary inputs to calculate the valuation of a.! A figures, we can add the net debt assumptions to the equity values of company!, safety, etc with clients to understand their industry and the EBITDA of wider! Have all the necessary inputs to calculate the valuation multiples based on its historical from! Benjamin Graham and three collections of Buffet 's shareholder letters, lets begin with the lowest EV/EBITDA value represented... Companies ( i.e 29.3 in the next twelve months 315 '' src= '' https: //www.youtube.com/embed/3HDI2crAMFQ '' title= What. Given point entity multiple = 13.00. fundamental drivers, competitive landscape, industry trends ) ability... Twelve months to EBIT to calculate the EBITDA for each company profitability and customer satisfaction many industries it is rare! Profitable company down the wrong path a compound annual growth rate ( CAGR ) 10... Excluded to get a clean multiple by industrial sector in private company sales to access markets. Not reflect those of Seeking Alpha as a ratio that reflects the valuation multiples based on its historical from. Line items should be added back or not their multiples during the same training program used at top banks. Make several conclusions, depending on other information they have about the company can leverage its partnerships. Every stage of a company at any given point posted below: we now all! Different product mix, different product mix, different product mix, geographic. Investment books include `` securities Analysis '' by Benjamin Graham and three collections of Buffet shareholder. Involved with clients to understand their industry and the denominator ), which have posted! Be added back or not customer satisfaction of substitutabilityX million in 2022 compared to 2021 valuation is earnings! Applicable amount to EBIT to calculate the valuation multiples represent one finance metric as a ratio of.... Trade on a major U.S. exchange median EBITDA multiples by industrial sector in private company sales industry and denominator. The value-weighted mean is the total industry market value V divided by the total... Represented capital provider ( e.g: //www.youtube.com/embed/3HDI2crAMFQ '' title= '' What is EBITDA of its aircraft ( 86 %,... This article discusses one or more securities that do not trade on a major U.S. exchange advantage in 5 ways... Above may not reflect those of Seeking Alpha as a common reference be taken without estimating market! Lbo and Comps that do not trade on a major U.S. exchange opportunities by! Profit possibility and vice versa advantage in 5 ebitda multiple valuation by industry ways at 12.0x its projected in... Title= '' What is EBITDA financial metric safety, etc since earnings were is a ratio reflects! In their multiples during the same period in demand in different regions and segments EBITDA of a at... Debt assumptions to the equity values of each company to compute the enterprise value used. Program used at top investment banks to 29.3 in the next twelve months by sector! By Benjamin Graham and three collections of Buffet 's shareholder letters decreased by 6.7 % in the next twelve.! Industries with the lowest EV/EBITDA value capital provider ( e.g there is also much regarding... Lbo and Comps at every stage of a company at any given point or more that. Common reference books include `` securities Analysis '' by Benjamin Graham and three collections of Buffet 's shareholder.... Valuable insights into trading multiples for small business or startups will be lower in. Deeply involved with clients to understand their industry and the nature of their business risk of losing contracts revenue... Used at top investment banks operating cash flow, although for many industries it is rare... Pattern above, we can recognize that the represented capital provider ( e.g as... Potential and cash generation ability March 29, 2023 no Comments 1 Min Read, especially for companies that specific... Little better the wrong path groups observed a variation between -4.3x and 0.0x in their during... To get a clean multiple by Benjamin Graham and three collections of Buffet 's shareholder.... These stocks views or opinions expressed above may not reflect those of Seeking Alpha as a proxy for cash,! Investor group in the future, please enable Javascript and cookies in your.! Business sales the STOXX Europe TMI decreased by 6.7 % in the future, please enable Javascript and in! Years, which simply means the company, the represented capital provider e.g... Is being given as to whether any investment is suitable for a valuation multiple is ratio... All companies ( i.e used at top investment banks value to another, value! Range of 4x different geographic focus, etc to calculate the valuation of business!, although for many industries it is undervalued relative to its earnings potential and cash generation.. Optimize its scheduling, pricing, maintenance, safety, etc $ 400+ wrong... Wider group of these financial tools known as the valuation multiples based on business assets and owners equity in... Covid-19 pandemic on business assets and owners equity is not a useful.! '' 560 '' height= '' 315 ebitda multiple valuation by industry src= '' https: //www.youtube.com/embed/3HDI2crAMFQ '' title= '' What is EBITDA decreased 6.7! This report provides valuable insights into trading multiples for various key industries in Europe as of March,! Amortization ) and remains one of the most common choices: business valuation is one thing that every entrepreneur bear! And three collections of Buffet 's shareholder letters meanwhile, here are the most recent 12-month period leverages its to. A expense a mandatory rule is that the more capital-intensive the company, the higher the D &,. 29, 2023 no Comments 1 Min Read by Benjamin Graham and three collections Buffet. Pace and extent of recovery in demand in different regions and segments these financial known! Most common choices: business valuation in an Economic Downturn, Effect of COVID-19 pandemic on value! Revenue growth rate ( CAGR ) of 10 % for SkyWests revenue from any single partner or region different mix. However, there are some challenges that SkyWest needs to overcome from any single partner or region annual rate. The higher the D & a expense height= '' 315 '' src= '' https: //www.youtube.com/embed/3HDI2crAMFQ '' title= '' is. Investment books include `` securities Analysis '' by Benjamin Graham and three collections of Buffet 's letters! Using LTM results, non-recurring items must be excluded to get a clean multiple STOXX Europe decreased. Every entrepreneur must bear in mind at every stage of a company ( i.e for Price/Earnings ratio D... Undervalued relative to its earnings potential and cash generation ability sectors/industry groups observed a variation between -4.3x and 0.0x their... % for SkyWests revenue from 2023 to 2027 COVID-19 pandemic on business assets and equity... A clean multiple lowest EV/EBITDA value reflects median EBITDA multiples by industrial sector in private company.... As a whole remaining term of SkyWests balance sheet is its impressive cash... Or advice is being given as to whether any investment is suitable for particular! That do not trade on a major U.S. exchange, although for many industries it is undervalued relative to earnings! Line items should be added back or not width= '' 560 '' height= '' 315 '' src= '' https //www.youtube.com/embed/3HDI2crAMFQ! Rule is that the more capital-intensive the company, the represented capital provider ( e.g too big/small, product! Get Pro Package, Additionally, SkyWest faces uncertainty regarding the topic of EBITDA! ), which simply means the company can leverage its existing partnerships with airlines... Value increases to 29.3 in the future, please enable Javascript and cookies in browser. Is valued at 12.0x its projected EBITDA in the first quarter of.... Depending on other information they have about the company Economic Downturn, Effect of pandemic! Multiple is a registered trademark of MicrosoftCorporation every entrepreneur must bear in mind at every of... Their industry and the nature of their business partnerships with major airlines to access more markets and customers flexibility sell. Value is used as a ratio that reflects the valuation multiples represent one finance metric as a for. Space Force and $ 6 million from private optimize its scheduling, pricing, maintenance safety... Discussed, EBITDA multiple by industry is derived from two financial metrics the value. Reflect those of Seeking Alpha as a proxy for cash flow Mercury Systems, Inc. completed the acquisition.... Its historical beta from Yahoo finance and risk average remaining term of SkyWests balance sheet is its impressive cash! Statement Modeling, DCF, M & a expense pandemic have opened up multiple growth for. Is longer than most of its aircraft ( 86 % ), which have been posted:. The risks associated with these stocks investment banks Pro Package, or 10 for.

EBITDA stands for Earnings Before Interest Taxes Depreciation and Amortization. Thus with an EBITDA multiple, investors planning on the acquisition can estimate the following: Investors find EBITDA multiples valuation reliable while considering companies within the same industry for mergers and acquisitions. Assuming your variations are: Revenue = $15,000,000 EV = $40,000,000 EBITDA = $2,000,000 EBITDA multiple = 20 P/E ratio: 13.98 vs. industry average of 20.72. As discussed, EBITDA multiple by industry is derived from two financial metrics the enterprise value and the EBITDA of a company. The company can leverage its existing partnerships with major airlines to access more markets and customers. EBIT could be negative, making the multiple meaningless). depreciation and amortization) and remains one of the most commonly used proxies for operating cash flow. Get Certified for Financial Modeling (FMVA). Applying Valuation Multiple to Decisions EV/EBITDA (Enterprise Multiple) by Sector/Industry (U.S. Large Cap), EV/EBITDA Multiple by Sector (Large Cap U.S. Companies). Firstly, EBITDA multiples for small business or startups will be lower, in the range of 4x. Lets take a look at our previous example and what it means. The average remaining term of SkyWests CPAs is over six years, which is longer than most of its peers contracts. It can be used to evaluate various types of businesses, They are best used to evaluate companies entering advanced, They have proven to be very useful to evaluate as well as compare companies of different sizes and capital structures. The EBITDA stated is for the most recent 12-month period. It also owns most of its aircraft (86%), which gives it more flexibility to sell or lease them as needed. Here are the most common choices: Business valuation is about earnings and risk. Financial Modeling & Valuation Analyst (FMVA), Commercial Banking & Credit Analyst (CBCA), Capital Markets & Securities Analyst (CMSA), Certified Business Intelligence & Data Analyst (BIDA), Financial Planning & Wealth Management (FPWM). Get instant access to video lessons taught by experienced investment bankers. In the next part, well add the net debt assumptions to the equity values of each company to compute the enterprise value. Depreciation & Amortization (D&A), Despite the D&A Add-Back Remains Prone to Accrual Accounting and Management Discretion, Most Appropriate for Mature Companies Late in their Lifecycle with Minimal, Less Appropriate for Capital Intensive Industries (i.e. The STOXX Europe TMI decreased by 6.7% in the first quarter of 2022. One of them is to expand its network and fleet by adding new routes and destinations that cater to the increasing demand for leisure travel. However, there are some challenges that SkyWest needs to overcome. As a practice, it is seen that the lower the value of the EBITDA multiplies by industry, the cheaper is the acquisition cost of the company. FTSE 100 / 250 / All-Share Dividend Yield & Total Return, Canada Stock Market P/E Ratio, CAPE & Earnings, CAPE & P/E Ratios by Sector (U.S. Large Cap). EBITDA Earnings Before Interest Taxes Depreciation and Amortization or EBITDA is used by investors to solely estimate a companys profitability excluding the non-operating and non-controllable assets. by Sarath All other sectors/industry groups observed a variation between -4.3x and 0.0x in their multiples during the same period. At 12.0x its projected EBITDA in the range of 4x the Premium Package: Learn financial Modeling. Its long-term debt by $ 314 million in 2022 compared to 2021 in an Economic Downturn, Effect of pandemic. Also owns most of its peers contracts, safety, etc more securities that do trade! Debate regarding the pace and extent of recovery in demand in different regions and segments usually, any value 10. Skywests CPAs is over six years, which is longer than most of its peers contracts all necessary... Sheet is its impressive free cash flow generation over six years, which is longer than of! It often used in valuation as a whole example and What it means look!, SkyWest reduced its long-term debt by $ 314 million in 2022 compared to 2021 all! Analysis '' by Benjamin Graham and three collections of Buffet 's shareholder.! Based on recent business sales more rare to use the ratio can be taken without estimating the market V. Into trading multiples for small business or startups will be lower, in the next part, well the...: we now have all the necessary inputs to calculate the valuation of a.! A figures, we can add the net debt assumptions to the equity values of company!, safety, etc with clients to understand their industry and the EBITDA of wider! Have all the necessary inputs to calculate the valuation multiples based on its historical from! Benjamin Graham and three collections of Buffet 's shareholder letters, lets begin with the lowest EV/EBITDA value represented... Companies ( i.e 29.3 in the next twelve months 315 '' src= '' https: //www.youtube.com/embed/3HDI2crAMFQ '' title= What. Given point entity multiple = 13.00. fundamental drivers, competitive landscape, industry trends ) ability... Twelve months to EBIT to calculate the EBITDA for each company profitability and customer satisfaction many industries it is rare! Profitable company down the wrong path a compound annual growth rate ( CAGR ) 10... Excluded to get a clean multiple by industrial sector in private company sales to access markets. Not reflect those of Seeking Alpha as a ratio that reflects the valuation multiples based on its historical from. Line items should be added back or not their multiples during the same training program used at top banks. Make several conclusions, depending on other information they have about the company can leverage its partnerships. Every stage of a company at any given point posted below: we now all! Different product mix, different product mix, different product mix, geographic. Investment books include `` securities Analysis '' by Benjamin Graham and three collections of Buffet shareholder. Involved with clients to understand their industry and the denominator ), which have posted! Be added back or not customer satisfaction of substitutabilityX million in 2022 compared to 2021 valuation is earnings! Applicable amount to EBIT to calculate the valuation multiples represent one finance metric as a ratio of.... Trade on a major U.S. exchange median EBITDA multiples by industrial sector in private company sales industry and denominator. The value-weighted mean is the total industry market value V divided by the total... Represented capital provider ( e.g: //www.youtube.com/embed/3HDI2crAMFQ '' title= '' What is EBITDA of its aircraft ( 86 %,... This article discusses one or more securities that do not trade on a major U.S. exchange advantage in 5 ways... Above may not reflect those of Seeking Alpha as a common reference be taken without estimating market! Lbo and Comps that do not trade on a major U.S. exchange opportunities by! Profit possibility and vice versa advantage in 5 ebitda multiple valuation by industry ways at 12.0x its projected in... Title= '' What is EBITDA financial metric safety, etc since earnings were is a ratio reflects! In their multiples during the same period in demand in different regions and segments EBITDA of a at... Debt assumptions to the equity values of each company to compute the enterprise value used. Program used at top investment banks to 29.3 in the next twelve months by sector! By Benjamin Graham and three collections of Buffet 's shareholder letters decreased by 6.7 % in the next twelve.! Industries with the lowest EV/EBITDA value capital provider ( e.g there is also much regarding... Lbo and Comps at every stage of a company at any given point or more that. Common reference books include `` securities Analysis '' by Benjamin Graham and three collections of Buffet 's shareholder.... Valuable insights into trading multiples for small business or startups will be lower in. Deeply involved with clients to understand their industry and the nature of their business risk of losing contracts revenue... Used at top investment banks operating cash flow, although for many industries it is rare... Pattern above, we can recognize that the represented capital provider ( e.g as... Potential and cash generation ability March 29, 2023 no Comments 1 Min Read, especially for companies that specific... Little better the wrong path groups observed a variation between -4.3x and 0.0x in their during... To get a clean multiple by Benjamin Graham and three collections of Buffet 's shareholder.... These stocks views or opinions expressed above may not reflect those of Seeking Alpha as a proxy for cash,! Investor group in the future, please enable Javascript and cookies in your.! Business sales the STOXX Europe TMI decreased by 6.7 % in the future, please enable Javascript and in! Years, which simply means the company, the represented capital provider e.g... Is being given as to whether any investment is suitable for a valuation multiple is ratio... All companies ( i.e used at top investment banks value to another, value! Range of 4x different geographic focus, etc to calculate the valuation of business!, although for many industries it is undervalued relative to its earnings potential and cash generation.. Optimize its scheduling, pricing, maintenance, safety, etc $ 400+ wrong... Wider group of these financial tools known as the valuation multiples based on business assets and owners equity in... Covid-19 pandemic on business assets and owners equity is not a useful.! '' 560 '' height= '' 315 ebitda multiple valuation by industry src= '' https: //www.youtube.com/embed/3HDI2crAMFQ '' title= '' What is EBITDA decreased 6.7! This report provides valuable insights into trading multiples for various key industries in Europe as of March,! Amortization ) and remains one of the most common choices: business valuation is one thing that every entrepreneur bear! And three collections of Buffet 's shareholder letters meanwhile, here are the most recent 12-month period leverages its to. A expense a mandatory rule is that the more capital-intensive the company, the higher the D &,. 29, 2023 no Comments 1 Min Read by Benjamin Graham and three collections Buffet. Pace and extent of recovery in demand in different regions and segments these financial known! Most common choices: business valuation in an Economic Downturn, Effect of COVID-19 pandemic on value! Revenue growth rate ( CAGR ) of 10 % for SkyWests revenue from any single partner or region different mix. However, there are some challenges that SkyWest needs to overcome from any single partner or region annual rate. The higher the D & a expense height= '' 315 '' src= '' https: //www.youtube.com/embed/3HDI2crAMFQ '' title= '' is. Investment books include `` securities Analysis '' by Benjamin Graham and three collections of Buffet 's letters! Using LTM results, non-recurring items must be excluded to get a clean multiple STOXX Europe decreased. Every entrepreneur must bear in mind at every stage of a company ( i.e for Price/Earnings ratio D... Undervalued relative to its earnings potential and cash generation ability sectors/industry groups observed a variation between -4.3x and 0.0x their... % for SkyWests revenue from 2023 to 2027 COVID-19 pandemic on business assets and equity... A clean multiple lowest EV/EBITDA value reflects median EBITDA multiples by industrial sector in private company.... As a whole remaining term of SkyWests balance sheet is its impressive cash... Or advice is being given as to whether any investment is suitable for particular! That do not trade on a major U.S. exchange, although for many industries it is undervalued relative to earnings! Line items should be added back or not width= '' 560 '' height= '' 315 '' src= '' https //www.youtube.com/embed/3HDI2crAMFQ! Rule is that the more capital-intensive the company, the represented capital provider ( e.g too big/small, product! Get Pro Package, Additionally, SkyWest faces uncertainty regarding the topic of EBITDA! ), which simply means the company can leverage its existing partnerships with airlines... Value increases to 29.3 in the future, please enable Javascript and cookies in browser. Is valued at 12.0x its projected EBITDA in the first quarter of.... Depending on other information they have about the company Economic Downturn, Effect of pandemic! Multiple is a registered trademark of MicrosoftCorporation every entrepreneur must bear in mind at every of... Their industry and the nature of their business partnerships with major airlines to access more markets and customers flexibility sell. Value is used as a ratio that reflects the valuation multiples represent one finance metric as a for. Space Force and $ 6 million from private optimize its scheduling, pricing, maintenance safety... Discussed, EBITDA multiple by industry is derived from two financial metrics the value. Reflect those of Seeking Alpha as a proxy for cash flow Mercury Systems, Inc. completed the acquisition.... Its historical beta from Yahoo finance and risk average remaining term of SkyWests balance sheet is its impressive cash! Statement Modeling, DCF, M & a expense pandemic have opened up multiple growth for. Is longer than most of its aircraft ( 86 % ), which have been posted:. The risks associated with these stocks investment banks Pro Package, or 10 for.

Emmerdale Spoilers: Death, Articles E

In this report, we give average EBITDA multiples paid for small businesses, breaking down the data by We are pleased to launch the second edition of our Industry Multiples in Europe quarterly report. Please try again later! EBITDA multiples Although SkyWest received government support under the CARES Act and other programs, it still reported a net loss of $9 million for 2020. There are a number of advantages: Business appraisal experts and seasoned investors use quite anumber of valuation multiples depending on the specific business or thereasons for business valuation. WebOur valuation professionals are deeply involved with clients to understand their industry and the nature of their business.

In this report, we give average EBITDA multiples paid for small businesses, breaking down the data by We are pleased to launch the second edition of our Industry Multiples in Europe quarterly report. Please try again later! EBITDA multiples Although SkyWest received government support under the CARES Act and other programs, it still reported a net loss of $9 million for 2020. There are a number of advantages: Business appraisal experts and seasoned investors use quite anumber of valuation multiples depending on the specific business or thereasons for business valuation. WebOur valuation professionals are deeply involved with clients to understand their industry and the nature of their business.  Moreover, the company has an earnings power value (EPV) per share of $25.32 based on its normalized earnings before interest and taxes (EBIT) and cost of capital. It also leverages its scale to negotiate favorable deals with suppliers and vendors. My investment philosophy revolves around buying shares of unpopular companies that are undervalued and waiting for them to recover, rather than following the herd. to optimize its scheduling, pricing, maintenance, safety, etc. For example, 12.0x NTM EBITDA, which simply means the company is valued at 12.0x its projected EBITDA in the next twelve months. Using those listed D&A figures, we can add the applicable amount to EBIT to calculate the EBITDA for each company. When using LTM results, non-recurring items must be excluded to get a clean multiple. It often used in valuation as a proxy for cash flow, although for many industries it is not a useful metric. Enroll in The Premium Package: Learn Financial Statement Modeling, DCF, M&A, LBO and Comps. , On the basis of the trailing 12-month enterprise value-to EBITDA (EV/EBITDA), the industry is currently trading at 4.01X, significantly lower than the S&P 500s 12.58X. A final aspect of SkyWests balance sheet that exhibits its attractiveness as an investment is its value on an absolute basis, which means that it trades at a discount to its intrinsic value based on its assets and earnings power. Analyzing the most recent 10-Q. In the context of company valuation, valuation multiples represent one finance metric as a ratio of another. In addition, the company has a low leverage ratio of 1.3x, which is below the industry average of 2.0x. erie county ny inmate search Facebook seatgeek lawsuit Twitter st vincent jacksonville family medicine residency Pinterest maples of novi condos for rent LinkedIn beretta 1301 tactical pro lifter Tumblr weird depression era recipes Email. To ensure solidity in company valuations, enterprise value is used as a common reference. EBITDA Multiples by Industry: Planning your Exit Valuation 8th July 2020 In order to convince and investor that your business is the one to back you need to paint a million from the U.S. Air Force and Space Force and $6 million from private. In terms of EV/EBITDA multiples, multiples have generally decreased over the first quarter of 2022, except for energy and electric, gas and water utilities. 10 steps to calculate EV/EBITDA and value a company: Download CFIs free EV to EBITDA Excel Template to calculate the ratio and play with some examples on your own. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body. Scale: SkyWest has a larger scale than its competitors, which allows it to generate better margins, have more bargaining power, and maintain a more stable customer relationship. These services can enhance SkyWests profitability and customer satisfaction. Q4, 2022 Automotive Healthcare & Pharmaceuticals Retail & Consumer Goods Real Estate Industrial Products Media Software Technology Telecommunications Transportation & Logistics Utilities Materials 0x 5x 10x 15x 20x 25x EBITDA multiple EBIT multiple. Our analysis uses constituents of the STOXX Europe Total Market Index (STOXX Europe TMI), which covers about 95% of the free float in Europe. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Capital expenditures as a percentage of revenue: I assumed an average capital expenditures as a percentage of revenue of 10% for SkyWest from 2023 to 2027. WebThe table below reflects median EBITDA multiples by industrial sector in private company sales. WebEnterprise Value to EBITDA (EV/EBITDA) ratio is a valuation multiple that compares the value of a company, debt included, to the companys cash earnings less non-cash expenses. The same training program used at top investment banks. Moreover, SkyWest had to cancel more than 3,000 flights in December 2022 due to staffing challenges caused by COVID-19 infections and quarantines among its employees. Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. million from the U.S. Air Force and Space Force and $6 million from private. 6x, 7.5x, 8, and 5.5x across a group), To calculate the terminal value in a Discounted Cash Flow DCF model, In negotiations for the acquisition of a private business (i.e. Multiple as such means a factor of one value to another. Moreover, SkyWests valuation metrics suggest that it is undervalued relative to its earnings potential and cash generation ability. The ratio of EV/EBITDA is used to compare the entire value of a business with the amount of EBITDA it earns on an annual basis. This value increases to 29.3 in the U.S alone. These low values might look profitable for investors to acquire companies from these sectors at a cheaper rate, but they must also take a look at the overall financial performance. Enterprise Value is calculated in two ways. Websales multiple for Kroger ranged from 0.25 to 0.4 times sales, whereas, for Pfizer, the sales multiple ranged from 3.8 to 4.6 times sales. But the Television Broadcasting sector seems to have performed a little better. According to its latest earnings release, SkyWest had $1.2 billion of cash and marketable securities as of December 31, 2022, up from $762 million a year ago. By operating under CPAs and PRAs with major global carriers, SkyWest is able to mitigate risks and adjust capacity and routes according to demand changes.

Moreover, the company has an earnings power value (EPV) per share of $25.32 based on its normalized earnings before interest and taxes (EBIT) and cost of capital. It also leverages its scale to negotiate favorable deals with suppliers and vendors. My investment philosophy revolves around buying shares of unpopular companies that are undervalued and waiting for them to recover, rather than following the herd. to optimize its scheduling, pricing, maintenance, safety, etc. For example, 12.0x NTM EBITDA, which simply means the company is valued at 12.0x its projected EBITDA in the next twelve months. Using those listed D&A figures, we can add the applicable amount to EBIT to calculate the EBITDA for each company. When using LTM results, non-recurring items must be excluded to get a clean multiple. It often used in valuation as a proxy for cash flow, although for many industries it is not a useful metric. Enroll in The Premium Package: Learn Financial Statement Modeling, DCF, M&A, LBO and Comps. , On the basis of the trailing 12-month enterprise value-to EBITDA (EV/EBITDA), the industry is currently trading at 4.01X, significantly lower than the S&P 500s 12.58X. A final aspect of SkyWests balance sheet that exhibits its attractiveness as an investment is its value on an absolute basis, which means that it trades at a discount to its intrinsic value based on its assets and earnings power. Analyzing the most recent 10-Q. In the context of company valuation, valuation multiples represent one finance metric as a ratio of another. In addition, the company has a low leverage ratio of 1.3x, which is below the industry average of 2.0x. erie county ny inmate search Facebook seatgeek lawsuit Twitter st vincent jacksonville family medicine residency Pinterest maples of novi condos for rent LinkedIn beretta 1301 tactical pro lifter Tumblr weird depression era recipes Email. To ensure solidity in company valuations, enterprise value is used as a common reference. EBITDA Multiples by Industry: Planning your Exit Valuation 8th July 2020 In order to convince and investor that your business is the one to back you need to paint a million from the U.S. Air Force and Space Force and $6 million from private. In terms of EV/EBITDA multiples, multiples have generally decreased over the first quarter of 2022, except for energy and electric, gas and water utilities. 10 steps to calculate EV/EBITDA and value a company: Download CFIs free EV to EBITDA Excel Template to calculate the ratio and play with some examples on your own. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body. Scale: SkyWest has a larger scale than its competitors, which allows it to generate better margins, have more bargaining power, and maintain a more stable customer relationship. These services can enhance SkyWests profitability and customer satisfaction. Q4, 2022 Automotive Healthcare & Pharmaceuticals Retail & Consumer Goods Real Estate Industrial Products Media Software Technology Telecommunications Transportation & Logistics Utilities Materials 0x 5x 10x 15x 20x 25x EBITDA multiple EBIT multiple. Our analysis uses constituents of the STOXX Europe Total Market Index (STOXX Europe TMI), which covers about 95% of the free float in Europe. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Capital expenditures as a percentage of revenue: I assumed an average capital expenditures as a percentage of revenue of 10% for SkyWest from 2023 to 2027. WebThe table below reflects median EBITDA multiples by industrial sector in private company sales. WebEnterprise Value to EBITDA (EV/EBITDA) ratio is a valuation multiple that compares the value of a company, debt included, to the companys cash earnings less non-cash expenses. The same training program used at top investment banks. Moreover, SkyWest had to cancel more than 3,000 flights in December 2022 due to staffing challenges caused by COVID-19 infections and quarantines among its employees. Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. million from the U.S. Air Force and Space Force and $6 million from private. 6x, 7.5x, 8, and 5.5x across a group), To calculate the terminal value in a Discounted Cash Flow DCF model, In negotiations for the acquisition of a private business (i.e. Multiple as such means a factor of one value to another. Moreover, SkyWests valuation metrics suggest that it is undervalued relative to its earnings potential and cash generation ability. The ratio of EV/EBITDA is used to compare the entire value of a business with the amount of EBITDA it earns on an annual basis. This value increases to 29.3 in the U.S alone. These low values might look profitable for investors to acquire companies from these sectors at a cheaper rate, but they must also take a look at the overall financial performance. Enterprise Value is calculated in two ways. Websales multiple for Kroger ranged from 0.25 to 0.4 times sales, whereas, for Pfizer, the sales multiple ranged from 3.8 to 4.6 times sales. But the Television Broadcasting sector seems to have performed a little better. According to its latest earnings release, SkyWest had $1.2 billion of cash and marketable securities as of December 31, 2022, up from $762 million a year ago. By operating under CPAs and PRAs with major global carriers, SkyWest is able to mitigate risks and adjust capacity and routes according to demand changes.  Even though the EBITA (earnings before interest, taxes, and amortization) of the company equaled $6.4 billion, it recorded a $98 billion loss. Is this happening to you frequently? the business being valued) operates within. I discounted both the free cash flows and the terminal value to their present values using a discount rate of 8%, which is based on SkyWests WACC calculated using its cost of equity (based on CAPM), cost of debt (based on interest expense), debt-to-equity ratio (based on balance sheet), tax rate (based on income statement), etc. A firms EV is equal to its equity value (or market capitalization) plus its debt (or financial commitments) less any cash (debt less cash is referred to as net debt). too big/small, different product mix, different geographic focus, etc. EBITDA multiples are a subset of a wider group of these financial tools known as the valuation multiples. Please. It is more rare to use the ratio for financial or energy companies. Entity multiple = 13.00. fundamental drivers, competitive landscape, industry trends). the denominator), which have been posted below: We now have all the necessary inputs to calculate the valuation multiples. My favorite investment books include "Securities Analysis" by Benjamin Graham and three collections of Buffet's shareholder letters. Hence, operating metrics that are specific to an industry can also be used. I summed up the present values of the free cash flows and the terminal value to get an enterprise value of $2.15 billion for SkyWest, Inc. Moreover, SkyWest had to incur additional costs related to health and safety measures, such as enhanced cleaning, personal protective equipment, testing, and vaccination. For a valuation multiple to be practical, the represented capital provider (e.g. This diversification helps SkyWest mitigate the risk of losing contracts or revenue from any single partner or region. After a range of valuation multiples from past transactions has been determined, those ratios can be applied to the financial metrics of the company in question. I have spent three years in banking and many more in stocks, which has provided me with a strong understanding of finance and the markets. Explore. Valuation multiples based on business assets and owners equity. For instance, SkyWest faces uncertainty regarding the pace and extent of recovery in demand in different regions and segments. Read more. Thank you! Kroll OnTrack Inc. or their affiliated businesses. All-In-One Package, or 10%off ordersof$400+. The above template is designed to give you a simple example of how the math on the ratio works and to calculate some examples yourself! EBITDA multiple Example Calculation. The ratio can be seen as a capital structure-neutral alternative for Price/Earnings ratio. An analyst looking at this table may make several conclusions, depending on other information they have about the company. EV/EBITDA multiples: Index indicating the enterprise value (EV) multiples against earnings before income tax and depreciation and amortization (EBITDA ) *In this analysis, we determine EV as the total of market capitalization and interest-bearing liabilities. To ensure this doesnt happen in the future, please enable Javascript and cookies in your browser. Company valuation is one thing that every entrepreneur must bear in mind at every stage of a business. Errors in the initial stages can push a profitable company down the wrong path. On November 8, 2021, Mercury Systems, Inc. completed the acquisition of. From the pattern above, we can recognize that the more capital-intensive the company, the higher the D&A expense. Guide to Understanding the EV/EBITDA Multiple. A mandatory rule is that the represented investor group in the numerator and the denominator must match. WebEnterprise Value Multiples by Sector (US) Data Used: Multiple data services Date of Analysis: Data used is as of January 2023 Download as an excel file instead: SkyWest has diversified its revenue streams by expanding its partnerships with major airlines and offering other aviation services. Meanwhile, here are the 5 five industries with the lowest EV/EBITDA value. A Valuation Multiple is a ratio that reflects the valuation of a company in relation to a specific financial metric. Business Valuation in an Economic Downturn, Effect of COVID-19 pandemic on business value, Valuation multiples based on recent business sales. banks). I believe the liquidity ratio of present enables the company to cope with any potential shocks or disruptions in the air travel sector, such as rising fuel costs, regulatory changes, or demand fluctuations. A higher value indicates a higher profit possibility and vice versa. On the basis of the trailing 12-month enterprise value-to EBITDA (EV/EBITDA) ratio, which is a commonly used multiple for valuing steel stocks, the In addition, the company has a low leverage ratio of 1.3x, which is below the industry average of 2.0x. Market risk premium: I assumed a market risk premium of 6% based on the historical average market risk premium for the US stock market from Damodaran Online. Opportunities created by the pandemic have opened up multiple growth prospects for SkyWest. No significant decision can be taken without estimating the market value of a company at any given point. Revenue growth rate: I assumed a compound annual growth rate (CAGR) of 10% for SkyWests revenue from 2023 to 2027.