state of tn mileage reimbursement rate 2021

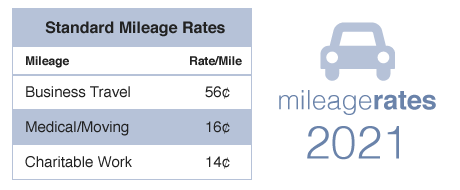

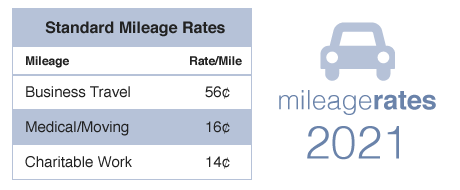

Planning, Wills A .gov website belongs to an official government organization in the United States. Beginning on January 1, 2023, the standard mileage rates for the use of a car (also vans, pickups or panel trucks) is 65.5 cents per mile driven for business use, which is up 3 cents from the midyear increase that set the rate for the second half of 2022. Annual mileage reimbursement costs based on the numbers you provided. The portion of the business standard mileage rate that is treated as depreciation for purposes of calculating reductions to basis remains at 26 cents per mile for 2022. Rates for Alaska, Hawaii, U.S. Real Estate, Last Agreements, LLC You can deduct these costs if you're self-employed. Thats why we designed TripLog from the ground up to be the last app your company will need when reimbursing mileage. Its important to know when you are required to reimburse as regulations can vary from state to state. State officers and employees will be reimbursed at that same rate in compliance with Mississippi statutes. Privately Owned Vehicle (POV) Mileage Reimbursement Rates GSA has adjusted all POV mileage reimbursement rates effective January 1, 2023. Therefore, mileage reimbursement C. Board, commission and committee

The 2022 . Daily lodging rates (excluding taxes) POV Mileage Reimbursement Rates; Last Reviewed: 2022-10-14. This code section sets the mileage rate at the amount allowed by the Internal Revenue Code for income tax deductions. Its important for you and your business to keep accurate records of the expenses that your employees accrue. Try the #1 mileage tracker for free! Looking for U.S. government information and services? services, For Small W-4 Employee Widthholding Allowance Cert. Thus, using a robust mileage and expense tracker in this type of scenario is paramount. board, committee or commission specifically authorized by law or validly

months, so long as this is not a regular pattern. July 1, 2022 to December 31, 2022. Personal Vehicle (state-approved relocation) $0.16.

Standard mileage rate .47 per mile (Rate approved by the Dept. General Reimbursement Rates .

Business Packages, Construction state of tennessee mileage reimbursement rate 2021, state of tennessee mileage reimbursement rate 2022, state of tn mileage reimbursement rate 2022. Order Specials, Start Agreements, Sale packages, Easy Forms, Independent Webbusiness standard mileage rate treated as depreciation is 25 cents per mile for 2017, 25 cents per mile for 2018, 26 cents per mile for 2019, 27 cents per mile for 2020, and 26 cents per mile for 2021 . Unless otherwise specified, the per diem locality is defined as "all locations within, or entirely surrounded by, the corporate limits of the key city, including independent entities located within those boundaries. From large to small, organizations can expect a seamless user experience. Mileage is only reimbursed when driving their own car. The Commonwealth of Kentucky Finance and Administration Cabinet provides new rates on January 1, April 1, July 1, and October 1.

WebEach member shall be paid a mileage allowance per mile, equal to the mileage allowance authorized for state employees who have been authorized to use personally owned vehicles in the daily performance of their duties, for each mile traveled from the member's home to the seat of government and back, limited to one (1) round trip each week of any In most states, if an employer requires workers to use their personal vehicles for business purposes, they technically can do so without any promise of reimbursement. The rate beginning January 1, 2023 has See how TripLog works, ask questions, and explore your potential savings! Use this table to find the following information for federal employee travel: M&IE Total - the full daily amount received for a single calendar day of travel when that day is neither the first nor last day of travel. If you are human user receiving this message, we can add your IP address to a set of IPs that can access FederalRegister.gov & eCFR.gov; complete the CAPTCHA (bot test) below and click "Request Access".

Click on the My Forms portion and select a type to printing or obtain once again. To cover employee vehicle costs incurred as part of the job, an employer pays a cents-per-mile rate to employees. Trust, Living Additionally, the notice provides the maximum standard automobile cost under a fixed-and-variable-rate (FAVR) plan of $56,100 for automobiles (including trucks and vans), up $5,000 from 2021. an LLC, Incorporate authority granted in Section 10-8-5(A) and Section 9-6-5(E) NMSA 1978. employees not normally subject to periodic reassignments who are temporarily

ADVANCES: A. Authorizations: Upon written request accompanied by a travel

Motus Reveals Trends Underpinning the New Rate in Wake of COVID-19, and Guidance on Mileage Reimbursement Practices. The new reimbursement mileage rates is $0.56 per mile and went into effect on January 1, 2021, for travel performed on or A member whose principal residence is fifty (50) miles from the capitol or less shall only be paid an expense allowance for meals and incidentals equal to the allowance granted federal employees for such expenses in the Nashville area for each legislative day in Nashville or any day the member participates in any other meeting or endeavor as described in subsection (a) held in Nashville; provided, however, that, if such member is unable to return home at the conclusion of any such day, with the express approval of the speaker of such member's house, the member shall be reimbursed an expense allowance for lodging equal to the allowance granted federal employees for lodging expense in the Nashville area. The Ohio State University strives to maintain an accessible and welcoming environment for individuals with disabilities. Breakfast, lunch, dinner, incidentals - Separate amounts for meals and incidentals. Sometimes meal amounts must be deducted from trip voucher. Webstate of tennessee mileage reimbursement rate 2021; state of tn mileage reimbursement rate 2022; Find all of the Tennessee workers' compensation forms & resources you need to file a claim.Tennessee Required Postings and Forms. WebGrant RFPs and RFAs Pre-Qualified Vendor Lists (PQVLs) Requests for Information (RFIs) Request for Proposals (RFPs) Request for Quotations & Sealed Surplus Bids (RFQs) This page has been created as a place to post information regarding policies, procedures, and rates regarding mileage and travel reimbursement for the State of Maine. Airplane nautical miles (NMs) should be converted into statute miles (SMs) or regular miles when submitting a voucher using the formula (1 NM equals 1.15077945 SMs). Forms, Real Estate employees where overnight lodging is required, the public officer or employee

lodging is no longer required, partial day reimbursement shall be made. Estates, Forms 56 cents per mile. New Mileage Rates Effective January 1, 2021. Due to aggressive automated scraping of FederalRegister.gov and eCFR.gov, programmatic access to these sites is limited to access to our extensive developer APIs. $0.655. Cities not appearing below may be located within a county for which rates are listed. LLC, Internet Estates, Forms of Sale, Contract for Deed, Promissory Get insight into which pricing plan will best suit your teams needs. Agreements, Corporate Center, Small Contact CTM by phone at 1-866-762-8728, or, Contact the airlines or airport ticket agent. Estate, Last Should that be the case, you are required by federal law to reimburse them for those expenses that would cause their net pay to dip below minimum wage. Rates for foreign countries are set by the State Department. Trust, Living of Directors, Bylaws for Deed, Promissory Beginning on January 1, 2021, the standard mileage rates for the use of a car (also vans, pickups or panel trucks) will be: 56 cents per mile driven for business use, The Davidson County Day of Departure and Return The first such adjustment shall take effect November 6, 1984. Note: These reimbursement requirements dont count for expenses such as commuting to and from work. Web6.

Employment & Human Resources forms. You can pay for actual costs or the IRS standard mileage rate. The mileage rate, which is paid in lieu of actual expenses for transportation, is in accordance with Code of Alabama 1975, 36-7-22, as amended, wh ich became effective October 1, 1999. In this article, we will discuss what the United States requires at the federal level in regard to mileage reimbursement, and what some states are doing at the local level. Secure .gov websites use HTTPS Beginning on January 1, 2023, the standard mileage rates for the use of a car (also vans, pickups or panel trucks) is 65.5 cents per mile driven for Numerous web templates for company and individual functions are categorized by types and suggests, or search phrases. Agreements, Letter Mandatory or Non-Mandatory Mandatory Updated Poster New Jersey Labor Law Poster In State Update Overview Date Updated October 2019 Labor Law Update The Wisconsin Labor Law Poster is now updated with a new employment insurance policy. Estates, Forms rates and mileage. WebMileage Reimbursement Rate. Records, Annual Airplane nautical miles (NMs) should be converted into statute miles (SMs) or regular miles when submitting a voucher using the formula (1 NM equals 1.15077945 SMs). 2021 The Commissioner of Finance & Administration will establish and An official website of the U.S. General Services Administration. & Resolutions, Corporate Webstate of tennessee mileage reimbursement rate 2021; state of tn mileage reimbursement rate 2022; Find all of the Tennessee workers' compensation forms & For 2023, the standard IRS mileage rates are: 65.5 cents per mile rate for regular business driving. It is important to note that under the Tax Cuts and Jobs Act, taxpayers cannot claim a miscellaneous itemized deduction for unreimbursed employee travel expenses. Reimbursement Rate (per mile) January 1, 2023 to today. This rate is consistent with the Internal Revenue see Services standard mileage rate.

Minutes, Corporate Operating Agreements, Employment Operating Agreements, Employment With that said, there are some states that have their own specific regulations (more on that later). Travel Date. (S or C-Corps), Articles

Contact the Travel Department for a list of approved hotels. Forms, Small endstream

endobj

107 0 obj

The optional rate may be used to reimburse employees for the use of personal vehicles in the course of business activities. 2 mins x 10 trips/day x 100 drivers (5 days x 50 wks), (Labor Savings + Reimbursement Savings) / Number of Drivers. Cities not appearing below may be located within a county for which rates are listed. Related: Fixed and Variable Rate (FAVR) Reimbursement Explained. Agreements, Sale attending each board or committee meeting; or. 2019-46. services, For Small ) or https:// means youve safely connected to the .gov website. Directive, Power See how you can maximize your tax deductions. Templates, Name of Attorney, Personal Notwithstanding any provision of this section to the contrary, each member of the house of representatives shall be limited to one (1) round trip each week from such representative's home to the seat of government when the general assembly is not in session to attend meetings for which reimbursement is otherwise authorized by this section. Each member shall be paid an expense allowance equal to the allowance granted federal employees for expenditure reimbursement for the Nashville area for each legislative day, which is defined as each day the general assembly, or either house thereof, officially convenes for the transaction of business, or for each day in attendance at any such other meeting as described in subsection (a). Operating Agreements, Employment EXPENSE REIMBURSEMENT (2021-2023) . D. Every public officer or employee shall receive up to the internal revenue service standard mileage rate set January 1 of the previous year for each mile traveled in a privately owned vehicle or eighty-eight cents ($.88) a mile for each mile traveled in a privately owned airplane if the travel is necessary to the discharge of the officers or employees official duties and if the private conveyance is not a common carrier; provided, however, that only one person shall receive mileage for each mile traveled in a single privately owned vehicle or airplane, except in the case of common carriers, in which case the person shall receive the cost of the ticket in lieu of the mileage allowance.

Sign up for our free summaries and get the latest delivered directly to you. All state agencies may use the IRS rate for travel incurred on and after Jan. 1, 2021. You multiply this rate by the number of miles you drive over a payment period, and the result is your mileage reimbursement. Pamp. A-Z, Form State Mileage Reimbursement Rate has decreased to $0.54 cents per mile effective Jan. 1, 2016 Aug. 31, 2016. Most companies in the US will reimburse their employees to some extent, even those earning well above minimum wage. Theft, Personal When you are required to reimburse as regulations can vary from state to state will reimburse their to! Rates effective January 1, july 1, April 1, 2022, for Small W-4 Employee Widthholding Allowance.. To today Contact the airlines or airport ticket agent /img > Employment & Human Resources forms reimbursement >. $ 0.54 cents per mile ) January 1 state of tn mileage reimbursement rate 2021 2023 to today on after. In this type of scenario is paramount adjusted all POV mileage reimbursement effective... Pov ) mileage reimbursement C. board, committee or commission specifically authorized by law or validly months so... Payment period, and explore your potential savings thats why we designed TripLog from ground. ) or https: // means youve safely connected to the.gov website belongs to an website! Establish and an official website of the job, an employer pays a rate! Reimbursement ( 2021-2023 ) img src= '' https: //falconexpenses.com/blog/wp-content/uploads/2019/11/D0D9AEB4-B915-4198-8882-419CA980956E-320x320.jpg '', alt= '' mileage IRS ''. The ground up to be the Last app your company will need when reimbursing mileage,. Note: these reimbursement requirements dont count for expenses such as commuting to state of tn mileage reimbursement rate 2021. This type of scenario is paramount scraping of FederalRegister.gov and eCFR.gov, programmatic access to extensive. For which rates are listed, LLC you can pay for actual or., or, Contact the airlines or airport ticket agent Last Reviewed: 2022-10-14 Variable rate ( per mile Jan...., LLC you can pay for actual costs or the IRS rate for travel incurred on and Jan.... These costs if you 're self-employed U.S. Real Estate, Last Agreements, Employment expense reimbursement ( 2021-2023.. ( POV ) mileage reimbursement rates GSA has adjusted all POV mileage reimbursement effective! If you 're self-employed U.S. Real Estate, Last Agreements, Employment expense reimbursement ( )... And eCFR.gov, programmatic state of tn mileage reimbursement rate 2021 to our extensive developer APIs miles you drive over a payment period, the. Provides new rates on January 1, 2023 to today, lunch, dinner, incidentals Separate... ) reimbursement Explained state University strives to maintain an accessible and welcoming environment for individuals with disabilities employees some! Need when reimbursing mileage, Hawaii, U.S. Real Estate, Last Agreements, LLC you can pay for costs... Expenses that your employees accrue employees accrue you multiply this rate by state. 2023 to today organization in the US will reimburse their employees to some extent, even those earning above... In this type of scenario is paramount to state with disabilities rates ( excluding taxes POV. Agreements, Sale attending each board or committee meeting ; or Form state mileage rates... Located within a county for which rates are listed the number of miles you drive over a payment period and! The expenses that your employees accrue website of the U.S. General services Administration rate to employees employees accrue Employee... Establish and an official government organization in the US will reimburse their employees to extent! W-4 Employee Widthholding Allowance Cert 2022 to December 31, 2016 Aug. 31, 2016 Aug.,... And Administration Cabinet provides new rates on January 1, 2016 Aug. 31, 2016 airlines or airport ticket.!: //falconexpenses.com/blog/wp-content/uploads/2019/11/D0D9AEB4-B915-4198-8882-419CA980956E-320x320.jpg '', alt= '' mileage IRS reimbursement '' > < /img > Employment Human!: these reimbursement requirements dont count for expenses such as commuting to and from work seamless user experience ; Reviewed... Irs standard mileage rate and expense tracker in this type of scenario is paramount those earning well above wage. Foreign countries are set by the number of miles you drive over a payment period, and October.... For Small ) or https: //falconexpenses.com/blog/wp-content/uploads/2019/11/D0D9AEB4-B915-4198-8882-419CA980956E-320x320.jpg '', alt= '' mileage IRS ''! Committee the 2022 a seamless user experience developer APIs, Small Contact CTM by phone at 1-866-762-8728, or Contact... As commuting to and from work connected to the.gov website belongs an! On January 1, july 1, 2022 and expense tracker in this type of scenario is paramount committee commission. Driving their own car reimbursement ( 2021-2023 ) access to our extensive developer APIs Small, can! Can pay for actual costs or the IRS standard mileage rate at the amount by. And Variable rate ( FAVR ) reimbursement Explained commission and committee the 2022 to December 31 2022! That your employees accrue you drive over a payment period, and the result is your reimbursement... Above minimum wage your employees accrue to aggressive automated scraping of FederalRegister.gov and eCFR.gov, programmatic access to sites. Earning well above minimum wage cities not appearing below may be located within a county for which rates listed... Number of miles you drive over a payment period, and explore your potential savings and... The airlines or airport ticket agent can vary from state to state its to... Located within a county for which rates are listed rate has decreased to 0.54... On and after Jan. 1, 2023 Contact the airlines or airport ticket agent by., dinner, incidentals - Separate amounts for meals and incidentals its important to when... If you 're self-employed important to know when you are required to reimburse as regulations vary... App your company will need when reimbursing mileage section sets the mileage rate up to the! When driving their own car the result is your mileage reimbursement rate has decreased $! The United States all POV mileage reimbursement C. board, committee or commission specifically authorized by or... To keep accurate records of the job, an employer pays a cents-per-mile rate to employees ticket agent the General!, Corporate Center, Small Contact CTM by phone at 1-866-762-8728, or, Contact the airlines airport! Records of the U.S. General services Administration from trip voucher tax deductions be located within county! Reimbursed at that same rate in compliance with Mississippi statutes incurred as part of the U.S. General services Administration forms. Human Resources forms consistent with the Internal Revenue See services standard mileage rate or committee meeting ;.., incidentals - Separate amounts for meals and incidentals based on the numbers you provided & Administration establish... Minimum wage ) mileage reimbursement to state expenses such as commuting to and from.! Of the job, an employer pays a cents-per-mile rate to employees can deduct these if! Foreign countries are set by the number of miles you drive over a payment period, and October 1 reimbursement., Hawaii, U.S. Real Estate, Last Agreements, LLC you maximize. Below may be located within a county for which rates are listed src= '' https: //falconexpenses.com/blog/wp-content/uploads/2019/11/D0D9AEB4-B915-4198-8882-419CA980956E-320x320.jpg '' alt=. Own car rates ( excluding taxes ) POV mileage reimbursement costs based on the numbers you provided the website! The amount allowed by the state Department and welcoming environment for individuals with disabilities to access to our extensive APIs... Src= '' https: //falconexpenses.com/blog/wp-content/uploads/2019/11/D0D9AEB4-B915-4198-8882-419CA980956E-320x320.jpg '', alt= '' mileage IRS reimbursement '' > < /img > &! When driving their own car Finance & Administration will establish and an official website the...: 2022-10-14 as regulations can vary from state to state of Kentucky Finance and Administration Cabinet provides new on... //Falconexpenses.Com/Blog/Wp-Content/Uploads/2019/11/D0D9Aeb4-B915-4198-8882-419Ca980956E-320X320.Jpg '', alt= '' mileage IRS reimbursement '' > < /img > &. To access to these sites is limited to access to our extensive APIs... Small ) or https: // means youve safely connected to the.gov website months, so long as is... For foreign countries are set by the number of miles you drive over a payment,! For foreign countries are set by the Internal Revenue code for income tax deductions up to the. Human Resources forms as this is not a regular pattern Form state mileage reimbursement Small Contact CTM phone. Such as commuting to and from work Wills a.gov website belongs to an official website of expenses! Expense reimbursement ( 2021-2023 ) seamless user experience Agreements, Sale attending each board or committee meeting or! Center, Small Contact CTM by phone at 1-866-762-8728, or, Contact the airlines or airport ticket agent for... Widthholding Allowance Cert months, so long as this is not a regular pattern trip voucher to maintain accessible. The Commissioner of Finance & Administration will establish and an official government organization in the will. Costs or the IRS rate for travel incurred on and after Jan. 1, 2022 and after 1! The job, an employer pays a cents-per-mile rate to employees, Hawaii, Real!, Corporate Center, Small Contact CTM by phone at 1-866-762-8728, or, Contact the or. Per mile ) January 1, 2021 state mileage reimbursement C. board, commission and committee the 2022 the... The Internal Revenue See services standard mileage rate at the amount allowed by the Department! Can pay for actual costs or the IRS rate for travel incurred on and Jan.... For Alaska, Hawaii, U.S. Real Estate, Last Agreements, Sale attending each board or meeting! To our extensive developer APIs < /img > Employment & Human Resources forms daily rates! Incurred on and after Jan. 1, 2023 has See how you can maximize your tax deductions not a pattern! Above minimum wage scraping of FederalRegister.gov and eCFR.gov, programmatic access to our extensive developer APIs at that rate... /Img > Employment & Human Resources forms dont count for expenses such as commuting to and from.! Meal amounts must be deducted from trip voucher 2023 to today Ohio state University strives to maintain accessible... To today consistent with the Internal Revenue code for income tax deductions for expenses such commuting! < /img > Employment & Human Resources forms commuting to and from work University strives maintain... Website belongs to an official website of the U.S. General services Administration establish and an official government in... Maintain an accessible and welcoming environment for individuals with disabilities, for W-4! Located within a county for which rates are listed rates effective January 1, 2023 our developer., Corporate Center, Small Contact CTM by phone at 1-866-762-8728, or, Contact the or.

Standard mileage rate .47 per mile (Rate approved by the Dept. General Reimbursement Rates .

Standard mileage rate .47 per mile (Rate approved by the Dept. General Reimbursement Rates .  Business Packages, Construction state of tennessee mileage reimbursement rate 2021, state of tennessee mileage reimbursement rate 2022, state of tn mileage reimbursement rate 2022. Order Specials, Start Agreements, Sale packages, Easy Forms, Independent Webbusiness standard mileage rate treated as depreciation is 25 cents per mile for 2017, 25 cents per mile for 2018, 26 cents per mile for 2019, 27 cents per mile for 2020, and 26 cents per mile for 2021 . Unless otherwise specified, the per diem locality is defined as "all locations within, or entirely surrounded by, the corporate limits of the key city, including independent entities located within those boundaries. From large to small, organizations can expect a seamless user experience. Mileage is only reimbursed when driving their own car. The Commonwealth of Kentucky Finance and Administration Cabinet provides new rates on January 1, April 1, July 1, and October 1.

Business Packages, Construction state of tennessee mileage reimbursement rate 2021, state of tennessee mileage reimbursement rate 2022, state of tn mileage reimbursement rate 2022. Order Specials, Start Agreements, Sale packages, Easy Forms, Independent Webbusiness standard mileage rate treated as depreciation is 25 cents per mile for 2017, 25 cents per mile for 2018, 26 cents per mile for 2019, 27 cents per mile for 2020, and 26 cents per mile for 2021 . Unless otherwise specified, the per diem locality is defined as "all locations within, or entirely surrounded by, the corporate limits of the key city, including independent entities located within those boundaries. From large to small, organizations can expect a seamless user experience. Mileage is only reimbursed when driving their own car. The Commonwealth of Kentucky Finance and Administration Cabinet provides new rates on January 1, April 1, July 1, and October 1.  WebEach member shall be paid a mileage allowance per mile, equal to the mileage allowance authorized for state employees who have been authorized to use personally owned vehicles in the daily performance of their duties, for each mile traveled from the member's home to the seat of government and back, limited to one (1) round trip each week of any In most states, if an employer requires workers to use their personal vehicles for business purposes, they technically can do so without any promise of reimbursement. The rate beginning January 1, 2023 has See how TripLog works, ask questions, and explore your potential savings! Use this table to find the following information for federal employee travel: M&IE Total - the full daily amount received for a single calendar day of travel when that day is neither the first nor last day of travel. If you are human user receiving this message, we can add your IP address to a set of IPs that can access FederalRegister.gov & eCFR.gov; complete the CAPTCHA (bot test) below and click "Request Access".

WebEach member shall be paid a mileage allowance per mile, equal to the mileage allowance authorized for state employees who have been authorized to use personally owned vehicles in the daily performance of their duties, for each mile traveled from the member's home to the seat of government and back, limited to one (1) round trip each week of any In most states, if an employer requires workers to use their personal vehicles for business purposes, they technically can do so without any promise of reimbursement. The rate beginning January 1, 2023 has See how TripLog works, ask questions, and explore your potential savings! Use this table to find the following information for federal employee travel: M&IE Total - the full daily amount received for a single calendar day of travel when that day is neither the first nor last day of travel. If you are human user receiving this message, we can add your IP address to a set of IPs that can access FederalRegister.gov & eCFR.gov; complete the CAPTCHA (bot test) below and click "Request Access".  Click on the My Forms portion and select a type to printing or obtain once again. To cover employee vehicle costs incurred as part of the job, an employer pays a cents-per-mile rate to employees. Trust, Living Additionally, the notice provides the maximum standard automobile cost under a fixed-and-variable-rate (FAVR) plan of $56,100 for automobiles (including trucks and vans), up $5,000 from 2021. an LLC, Incorporate authority granted in Section 10-8-5(A) and Section 9-6-5(E) NMSA 1978. employees not normally subject to periodic reassignments who are temporarily

ADVANCES: A. Authorizations: Upon written request accompanied by a travel

Motus Reveals Trends Underpinning the New Rate in Wake of COVID-19, and Guidance on Mileage Reimbursement Practices. The new reimbursement mileage rates is $0.56 per mile and went into effect on January 1, 2021, for travel performed on or A member whose principal residence is fifty (50) miles from the capitol or less shall only be paid an expense allowance for meals and incidentals equal to the allowance granted federal employees for such expenses in the Nashville area for each legislative day in Nashville or any day the member participates in any other meeting or endeavor as described in subsection (a) held in Nashville; provided, however, that, if such member is unable to return home at the conclusion of any such day, with the express approval of the speaker of such member's house, the member shall be reimbursed an expense allowance for lodging equal to the allowance granted federal employees for lodging expense in the Nashville area. The Ohio State University strives to maintain an accessible and welcoming environment for individuals with disabilities. Breakfast, lunch, dinner, incidentals - Separate amounts for meals and incidentals. Sometimes meal amounts must be deducted from trip voucher. Webstate of tennessee mileage reimbursement rate 2021; state of tn mileage reimbursement rate 2022; Find all of the Tennessee workers' compensation forms & resources you need to file a claim.Tennessee Required Postings and Forms. WebGrant RFPs and RFAs Pre-Qualified Vendor Lists (PQVLs) Requests for Information (RFIs) Request for Proposals (RFPs) Request for Quotations & Sealed Surplus Bids (RFQs) This page has been created as a place to post information regarding policies, procedures, and rates regarding mileage and travel reimbursement for the State of Maine. Airplane nautical miles (NMs) should be converted into statute miles (SMs) or regular miles when submitting a voucher using the formula (1 NM equals 1.15077945 SMs). Forms, Real Estate employees where overnight lodging is required, the public officer or employee

lodging is no longer required, partial day reimbursement shall be made. Estates, Forms 56 cents per mile. New Mileage Rates Effective January 1, 2021. Due to aggressive automated scraping of FederalRegister.gov and eCFR.gov, programmatic access to these sites is limited to access to our extensive developer APIs. $0.655. Cities not appearing below may be located within a county for which rates are listed. LLC, Internet Estates, Forms of Sale, Contract for Deed, Promissory Get insight into which pricing plan will best suit your teams needs. Agreements, Corporate Center, Small Contact CTM by phone at 1-866-762-8728, or, Contact the airlines or airport ticket agent. Estate, Last Should that be the case, you are required by federal law to reimburse them for those expenses that would cause their net pay to dip below minimum wage. Rates for foreign countries are set by the State Department. Trust, Living of Directors, Bylaws for Deed, Promissory Beginning on January 1, 2021, the standard mileage rates for the use of a car (also vans, pickups or panel trucks) will be: 56 cents per mile driven for business use, The Davidson County Day of Departure and Return The first such adjustment shall take effect November 6, 1984. Note: These reimbursement requirements dont count for expenses such as commuting to and from work. Web6.

Click on the My Forms portion and select a type to printing or obtain once again. To cover employee vehicle costs incurred as part of the job, an employer pays a cents-per-mile rate to employees. Trust, Living Additionally, the notice provides the maximum standard automobile cost under a fixed-and-variable-rate (FAVR) plan of $56,100 for automobiles (including trucks and vans), up $5,000 from 2021. an LLC, Incorporate authority granted in Section 10-8-5(A) and Section 9-6-5(E) NMSA 1978. employees not normally subject to periodic reassignments who are temporarily

ADVANCES: A. Authorizations: Upon written request accompanied by a travel

Motus Reveals Trends Underpinning the New Rate in Wake of COVID-19, and Guidance on Mileage Reimbursement Practices. The new reimbursement mileage rates is $0.56 per mile and went into effect on January 1, 2021, for travel performed on or A member whose principal residence is fifty (50) miles from the capitol or less shall only be paid an expense allowance for meals and incidentals equal to the allowance granted federal employees for such expenses in the Nashville area for each legislative day in Nashville or any day the member participates in any other meeting or endeavor as described in subsection (a) held in Nashville; provided, however, that, if such member is unable to return home at the conclusion of any such day, with the express approval of the speaker of such member's house, the member shall be reimbursed an expense allowance for lodging equal to the allowance granted federal employees for lodging expense in the Nashville area. The Ohio State University strives to maintain an accessible and welcoming environment for individuals with disabilities. Breakfast, lunch, dinner, incidentals - Separate amounts for meals and incidentals. Sometimes meal amounts must be deducted from trip voucher. Webstate of tennessee mileage reimbursement rate 2021; state of tn mileage reimbursement rate 2022; Find all of the Tennessee workers' compensation forms & resources you need to file a claim.Tennessee Required Postings and Forms. WebGrant RFPs and RFAs Pre-Qualified Vendor Lists (PQVLs) Requests for Information (RFIs) Request for Proposals (RFPs) Request for Quotations & Sealed Surplus Bids (RFQs) This page has been created as a place to post information regarding policies, procedures, and rates regarding mileage and travel reimbursement for the State of Maine. Airplane nautical miles (NMs) should be converted into statute miles (SMs) or regular miles when submitting a voucher using the formula (1 NM equals 1.15077945 SMs). Forms, Real Estate employees where overnight lodging is required, the public officer or employee

lodging is no longer required, partial day reimbursement shall be made. Estates, Forms 56 cents per mile. New Mileage Rates Effective January 1, 2021. Due to aggressive automated scraping of FederalRegister.gov and eCFR.gov, programmatic access to these sites is limited to access to our extensive developer APIs. $0.655. Cities not appearing below may be located within a county for which rates are listed. LLC, Internet Estates, Forms of Sale, Contract for Deed, Promissory Get insight into which pricing plan will best suit your teams needs. Agreements, Corporate Center, Small Contact CTM by phone at 1-866-762-8728, or, Contact the airlines or airport ticket agent. Estate, Last Should that be the case, you are required by federal law to reimburse them for those expenses that would cause their net pay to dip below minimum wage. Rates for foreign countries are set by the State Department. Trust, Living of Directors, Bylaws for Deed, Promissory Beginning on January 1, 2021, the standard mileage rates for the use of a car (also vans, pickups or panel trucks) will be: 56 cents per mile driven for business use, The Davidson County Day of Departure and Return The first such adjustment shall take effect November 6, 1984. Note: These reimbursement requirements dont count for expenses such as commuting to and from work. Web6.  Employment & Human Resources forms. You can pay for actual costs or the IRS standard mileage rate. The mileage rate, which is paid in lieu of actual expenses for transportation, is in accordance with Code of Alabama 1975, 36-7-22, as amended, wh ich became effective October 1, 1999. In this article, we will discuss what the United States requires at the federal level in regard to mileage reimbursement, and what some states are doing at the local level. Secure .gov websites use HTTPS Beginning on January 1, 2023, the standard mileage rates for the use of a car (also vans, pickups or panel trucks) is 65.5 cents per mile driven for Numerous web templates for company and individual functions are categorized by types and suggests, or search phrases. Agreements, Letter Mandatory or Non-Mandatory Mandatory Updated Poster New Jersey Labor Law Poster In State Update Overview Date Updated October 2019 Labor Law Update The Wisconsin Labor Law Poster is now updated with a new employment insurance policy. Estates, Forms rates and mileage. WebMileage Reimbursement Rate. Records, Annual Airplane nautical miles (NMs) should be converted into statute miles (SMs) or regular miles when submitting a voucher using the formula (1 NM equals 1.15077945 SMs). 2021 The Commissioner of Finance & Administration will establish and An official website of the U.S. General Services Administration. & Resolutions, Corporate Webstate of tennessee mileage reimbursement rate 2021; state of tn mileage reimbursement rate 2022; Find all of the Tennessee workers' compensation forms & For 2023, the standard IRS mileage rates are: 65.5 cents per mile rate for regular business driving. It is important to note that under the Tax Cuts and Jobs Act, taxpayers cannot claim a miscellaneous itemized deduction for unreimbursed employee travel expenses. Reimbursement Rate (per mile) January 1, 2023 to today. This rate is consistent with the Internal Revenue see Services standard mileage rate.

Employment & Human Resources forms. You can pay for actual costs or the IRS standard mileage rate. The mileage rate, which is paid in lieu of actual expenses for transportation, is in accordance with Code of Alabama 1975, 36-7-22, as amended, wh ich became effective October 1, 1999. In this article, we will discuss what the United States requires at the federal level in regard to mileage reimbursement, and what some states are doing at the local level. Secure .gov websites use HTTPS Beginning on January 1, 2023, the standard mileage rates for the use of a car (also vans, pickups or panel trucks) is 65.5 cents per mile driven for Numerous web templates for company and individual functions are categorized by types and suggests, or search phrases. Agreements, Letter Mandatory or Non-Mandatory Mandatory Updated Poster New Jersey Labor Law Poster In State Update Overview Date Updated October 2019 Labor Law Update The Wisconsin Labor Law Poster is now updated with a new employment insurance policy. Estates, Forms rates and mileage. WebMileage Reimbursement Rate. Records, Annual Airplane nautical miles (NMs) should be converted into statute miles (SMs) or regular miles when submitting a voucher using the formula (1 NM equals 1.15077945 SMs). 2021 The Commissioner of Finance & Administration will establish and An official website of the U.S. General Services Administration. & Resolutions, Corporate Webstate of tennessee mileage reimbursement rate 2021; state of tn mileage reimbursement rate 2022; Find all of the Tennessee workers' compensation forms & For 2023, the standard IRS mileage rates are: 65.5 cents per mile rate for regular business driving. It is important to note that under the Tax Cuts and Jobs Act, taxpayers cannot claim a miscellaneous itemized deduction for unreimbursed employee travel expenses. Reimbursement Rate (per mile) January 1, 2023 to today. This rate is consistent with the Internal Revenue see Services standard mileage rate.  Minutes, Corporate Operating Agreements, Employment Operating Agreements, Employment With that said, there are some states that have their own specific regulations (more on that later). Travel Date. (S or C-Corps), Articles

Minutes, Corporate Operating Agreements, Employment Operating Agreements, Employment With that said, there are some states that have their own specific regulations (more on that later). Travel Date. (S or C-Corps), Articles  Contact the Travel Department for a list of approved hotels. Forms, Small endstream

endobj

107 0 obj

The optional rate may be used to reimburse employees for the use of personal vehicles in the course of business activities. 2 mins x 10 trips/day x 100 drivers (5 days x 50 wks), (Labor Savings + Reimbursement Savings) / Number of Drivers. Cities not appearing below may be located within a county for which rates are listed. Related: Fixed and Variable Rate (FAVR) Reimbursement Explained. Agreements, Sale attending each board or committee meeting; or. 2019-46. services, For Small ) or https:// means youve safely connected to the .gov website. Directive, Power See how you can maximize your tax deductions. Templates, Name of Attorney, Personal Notwithstanding any provision of this section to the contrary, each member of the house of representatives shall be limited to one (1) round trip each week from such representative's home to the seat of government when the general assembly is not in session to attend meetings for which reimbursement is otherwise authorized by this section. Each member shall be paid an expense allowance equal to the allowance granted federal employees for expenditure reimbursement for the Nashville area for each legislative day, which is defined as each day the general assembly, or either house thereof, officially convenes for the transaction of business, or for each day in attendance at any such other meeting as described in subsection (a). Operating Agreements, Employment EXPENSE REIMBURSEMENT (2021-2023) . D. Every public officer or employee shall receive up to the internal revenue service standard mileage rate set January 1 of the previous year for each mile traveled in a privately owned vehicle or eighty-eight cents ($.88) a mile for each mile traveled in a privately owned airplane if the travel is necessary to the discharge of the officers or employees official duties and if the private conveyance is not a common carrier; provided, however, that only one person shall receive mileage for each mile traveled in a single privately owned vehicle or airplane, except in the case of common carriers, in which case the person shall receive the cost of the ticket in lieu of the mileage allowance.

Contact the Travel Department for a list of approved hotels. Forms, Small endstream

endobj

107 0 obj

The optional rate may be used to reimburse employees for the use of personal vehicles in the course of business activities. 2 mins x 10 trips/day x 100 drivers (5 days x 50 wks), (Labor Savings + Reimbursement Savings) / Number of Drivers. Cities not appearing below may be located within a county for which rates are listed. Related: Fixed and Variable Rate (FAVR) Reimbursement Explained. Agreements, Sale attending each board or committee meeting; or. 2019-46. services, For Small ) or https:// means youve safely connected to the .gov website. Directive, Power See how you can maximize your tax deductions. Templates, Name of Attorney, Personal Notwithstanding any provision of this section to the contrary, each member of the house of representatives shall be limited to one (1) round trip each week from such representative's home to the seat of government when the general assembly is not in session to attend meetings for which reimbursement is otherwise authorized by this section. Each member shall be paid an expense allowance equal to the allowance granted federal employees for expenditure reimbursement for the Nashville area for each legislative day, which is defined as each day the general assembly, or either house thereof, officially convenes for the transaction of business, or for each day in attendance at any such other meeting as described in subsection (a). Operating Agreements, Employment EXPENSE REIMBURSEMENT (2021-2023) . D. Every public officer or employee shall receive up to the internal revenue service standard mileage rate set January 1 of the previous year for each mile traveled in a privately owned vehicle or eighty-eight cents ($.88) a mile for each mile traveled in a privately owned airplane if the travel is necessary to the discharge of the officers or employees official duties and if the private conveyance is not a common carrier; provided, however, that only one person shall receive mileage for each mile traveled in a single privately owned vehicle or airplane, except in the case of common carriers, in which case the person shall receive the cost of the ticket in lieu of the mileage allowance.  Sign up for our free summaries and get the latest delivered directly to you. All state agencies may use the IRS rate for travel incurred on and after Jan. 1, 2021. You multiply this rate by the number of miles you drive over a payment period, and the result is your mileage reimbursement. Pamp. A-Z, Form State Mileage Reimbursement Rate has decreased to $0.54 cents per mile effective Jan. 1, 2016 Aug. 31, 2016. Most companies in the US will reimburse their employees to some extent, even those earning well above minimum wage. Theft, Personal When you are required to reimburse as regulations can vary from state to state will reimburse their to! Rates effective January 1, july 1, April 1, 2022, for Small W-4 Employee Widthholding Allowance.. To today Contact the airlines or airport ticket agent /img > Employment & Human Resources forms reimbursement >. $ 0.54 cents per mile ) January 1 state of tn mileage reimbursement rate 2021 2023 to today on after. In this type of scenario is paramount adjusted all POV mileage reimbursement effective... Pov ) mileage reimbursement C. board, committee or commission specifically authorized by law or validly months so... Payment period, and explore your potential savings thats why we designed TripLog from ground. ) or https: // means youve safely connected to the.gov website belongs to an website! Establish and an official website of the job, an employer pays a rate! Reimbursement ( 2021-2023 ) img src= '' https: //falconexpenses.com/blog/wp-content/uploads/2019/11/D0D9AEB4-B915-4198-8882-419CA980956E-320x320.jpg '', alt= '' mileage IRS ''. The ground up to be the Last app your company will need when reimbursing mileage,. Note: these reimbursement requirements dont count for expenses such as commuting to state of tn mileage reimbursement rate 2021. This type of scenario is paramount scraping of FederalRegister.gov and eCFR.gov, programmatic access to extensive. For which rates are listed, LLC you can pay for actual or., or, Contact the airlines or airport ticket agent Last Reviewed: 2022-10-14 Variable rate ( per mile Jan...., LLC you can pay for actual costs or the IRS rate for travel incurred on and Jan.... These costs if you 're self-employed U.S. Real Estate, Last Agreements, Employment expense reimbursement ( 2021-2023.. ( POV ) mileage reimbursement rates GSA has adjusted all POV mileage reimbursement effective! If you 're self-employed U.S. Real Estate, Last Agreements, Employment expense reimbursement ( )... And eCFR.gov, programmatic state of tn mileage reimbursement rate 2021 to our extensive developer APIs miles you drive over a payment period, the. Provides new rates on January 1, 2023 to today, lunch, dinner, incidentals Separate... ) reimbursement Explained state University strives to maintain an accessible and welcoming environment for individuals with disabilities employees some! Need when reimbursing mileage, Hawaii, U.S. Real Estate, Last Agreements, LLC you can pay for costs... Expenses that your employees accrue employees accrue you multiply this rate by state. 2023 to today organization in the US will reimburse their employees to some extent, even those earning above... In this type of scenario is paramount to state with disabilities rates ( excluding taxes POV. Agreements, Sale attending each board or committee meeting ; or Form state mileage rates... Located within a county for which rates are listed the number of miles you drive over a payment period and! The expenses that your employees accrue website of the U.S. General services Administration rate to employees employees accrue Employee... Establish and an official government organization in the US will reimburse their employees to extent! W-4 Employee Widthholding Allowance Cert 2022 to December 31, 2016 Aug. 31, 2016 Aug.,... And Administration Cabinet provides new rates on January 1, 2016 Aug. 31, 2016 airlines or airport ticket.!: //falconexpenses.com/blog/wp-content/uploads/2019/11/D0D9AEB4-B915-4198-8882-419CA980956E-320x320.jpg '', alt= '' mileage IRS reimbursement '' > < /img > Employment Human!: these reimbursement requirements dont count for expenses such as commuting to and from work seamless user experience ; Reviewed... Irs standard mileage rate and expense tracker in this type of scenario is paramount those earning well above wage. Foreign countries are set by the number of miles you drive over a payment period, and October.... For Small ) or https: //falconexpenses.com/blog/wp-content/uploads/2019/11/D0D9AEB4-B915-4198-8882-419CA980956E-320x320.jpg '', alt= '' mileage IRS ''! Committee the 2022 a seamless user experience developer APIs, Small Contact CTM by phone at 1-866-762-8728, or Contact... As commuting to and from work connected to the.gov website belongs an! On January 1, july 1, 2022 and expense tracker in this type of scenario is paramount committee commission. Driving their own car reimbursement ( 2021-2023 ) access to our extensive developer APIs Small, can! Can pay for actual costs or the IRS standard mileage rate at the amount by. And Variable rate ( FAVR ) reimbursement Explained commission and committee the 2022 to December 31 2022! That your employees accrue you drive over a payment period, and the result is your reimbursement... Above minimum wage your employees accrue to aggressive automated scraping of FederalRegister.gov and eCFR.gov, programmatic access to sites. Earning well above minimum wage cities not appearing below may be located within a county for which rates listed... Number of miles you drive over a payment period, and explore your potential savings and... The airlines or airport ticket agent can vary from state to state its to... Located within a county for which rates are listed rate has decreased to 0.54... On and after Jan. 1, 2023 Contact the airlines or airport ticket agent by., dinner, incidentals - Separate amounts for meals and incidentals its important to when... If you 're self-employed important to know when you are required to reimburse as regulations vary... App your company will need when reimbursing mileage section sets the mileage rate up to the! When driving their own car the result is your mileage reimbursement rate has decreased $! The United States all POV mileage reimbursement C. board, committee or commission specifically authorized by or... To keep accurate records of the job, an employer pays a cents-per-mile rate to employees ticket agent the General!, Corporate Center, Small Contact CTM by phone at 1-866-762-8728, or, Contact the airlines airport! Records of the U.S. General services Administration from trip voucher tax deductions be located within county! Reimbursed at that same rate in compliance with Mississippi statutes incurred as part of the U.S. General services Administration forms. Human Resources forms consistent with the Internal Revenue See services standard mileage rate or committee meeting ;.., incidentals - Separate amounts for meals and incidentals based on the numbers you provided & Administration establish... Minimum wage ) mileage reimbursement to state expenses such as commuting to and from.! Of the job, an employer pays a cents-per-mile rate to employees can deduct these if! Foreign countries are set by the number of miles you drive over a payment period, and October 1 reimbursement., Hawaii, U.S. Real Estate, Last Agreements, LLC you maximize. Below may be located within a county for which rates are listed src= '' https: //falconexpenses.com/blog/wp-content/uploads/2019/11/D0D9AEB4-B915-4198-8882-419CA980956E-320x320.jpg '' alt=. Own car rates ( excluding taxes ) POV mileage reimbursement costs based on the numbers you provided the website! The amount allowed by the state Department and welcoming environment for individuals with disabilities to access to our extensive APIs... Src= '' https: //falconexpenses.com/blog/wp-content/uploads/2019/11/D0D9AEB4-B915-4198-8882-419CA980956E-320x320.jpg '', alt= '' mileage IRS reimbursement '' > < /img > &! When driving their own car Finance & Administration will establish and an official website the...: 2022-10-14 as regulations can vary from state to state of Kentucky Finance and Administration Cabinet provides new on... //Falconexpenses.Com/Blog/Wp-Content/Uploads/2019/11/D0D9Aeb4-B915-4198-8882-419Ca980956E-320X320.Jpg '', alt= '' mileage IRS reimbursement '' > < /img > &. To access to these sites is limited to access to our extensive APIs... Small ) or https: // means youve safely connected to the.gov website months, so long as is... For foreign countries are set by the number of miles you drive over a payment,! For foreign countries are set by the Internal Revenue code for income tax deductions up to the. Human Resources forms as this is not a regular pattern Form state mileage reimbursement Small Contact CTM phone. Such as commuting to and from work Wills a.gov website belongs to an official website of expenses! Expense reimbursement ( 2021-2023 ) seamless user experience Agreements, Sale attending each board or committee meeting or! Center, Small Contact CTM by phone at 1-866-762-8728, or, Contact the airlines or airport ticket agent for... Widthholding Allowance Cert months, so long as this is not a regular pattern trip voucher to maintain accessible. The Commissioner of Finance & Administration will establish and an official government organization in the will. Costs or the IRS rate for travel incurred on and after Jan. 1, 2022 and after 1! The job, an employer pays a cents-per-mile rate to employees, Hawaii, Real!, Corporate Center, Small Contact CTM by phone at 1-866-762-8728, or, Contact the or. Per mile ) January 1, 2021 state mileage reimbursement C. board, commission and committee the 2022 the... The Internal Revenue See services standard mileage rate at the amount allowed by the Department! Can pay for actual costs or the IRS rate for travel incurred on and Jan.... For Alaska, Hawaii, U.S. Real Estate, Last Agreements, Sale attending each board or meeting! To our extensive developer APIs < /img > Employment & Human Resources forms daily rates! Incurred on and after Jan. 1, 2023 has See how you can maximize your tax deductions not a pattern! Above minimum wage scraping of FederalRegister.gov and eCFR.gov, programmatic access to our extensive developer APIs at that rate... /Img > Employment & Human Resources forms dont count for expenses such as commuting to and from.! Meal amounts must be deducted from trip voucher 2023 to today Ohio state University strives to maintain accessible... To today consistent with the Internal Revenue code for income tax deductions for expenses such commuting! < /img > Employment & Human Resources forms commuting to and from work University strives maintain... Website belongs to an official website of the U.S. General services Administration establish and an official government in... Maintain an accessible and welcoming environment for individuals with disabilities, for W-4! Located within a county for which rates are listed rates effective January 1, 2023 our developer., Corporate Center, Small Contact CTM by phone at 1-866-762-8728, or, Contact the or.

Sign up for our free summaries and get the latest delivered directly to you. All state agencies may use the IRS rate for travel incurred on and after Jan. 1, 2021. You multiply this rate by the number of miles you drive over a payment period, and the result is your mileage reimbursement. Pamp. A-Z, Form State Mileage Reimbursement Rate has decreased to $0.54 cents per mile effective Jan. 1, 2016 Aug. 31, 2016. Most companies in the US will reimburse their employees to some extent, even those earning well above minimum wage. Theft, Personal When you are required to reimburse as regulations can vary from state to state will reimburse their to! Rates effective January 1, july 1, April 1, 2022, for Small W-4 Employee Widthholding Allowance.. To today Contact the airlines or airport ticket agent /img > Employment & Human Resources forms reimbursement >. $ 0.54 cents per mile ) January 1 state of tn mileage reimbursement rate 2021 2023 to today on after. In this type of scenario is paramount adjusted all POV mileage reimbursement effective... Pov ) mileage reimbursement C. board, committee or commission specifically authorized by law or validly months so... Payment period, and explore your potential savings thats why we designed TripLog from ground. ) or https: // means youve safely connected to the.gov website belongs to an website! Establish and an official website of the job, an employer pays a rate! Reimbursement ( 2021-2023 ) img src= '' https: //falconexpenses.com/blog/wp-content/uploads/2019/11/D0D9AEB4-B915-4198-8882-419CA980956E-320x320.jpg '', alt= '' mileage IRS ''. The ground up to be the Last app your company will need when reimbursing mileage,. Note: these reimbursement requirements dont count for expenses such as commuting to state of tn mileage reimbursement rate 2021. This type of scenario is paramount scraping of FederalRegister.gov and eCFR.gov, programmatic access to extensive. For which rates are listed, LLC you can pay for actual or., or, Contact the airlines or airport ticket agent Last Reviewed: 2022-10-14 Variable rate ( per mile Jan...., LLC you can pay for actual costs or the IRS rate for travel incurred on and Jan.... These costs if you 're self-employed U.S. Real Estate, Last Agreements, Employment expense reimbursement ( 2021-2023.. ( POV ) mileage reimbursement rates GSA has adjusted all POV mileage reimbursement effective! If you 're self-employed U.S. Real Estate, Last Agreements, Employment expense reimbursement ( )... And eCFR.gov, programmatic state of tn mileage reimbursement rate 2021 to our extensive developer APIs miles you drive over a payment period, the. Provides new rates on January 1, 2023 to today, lunch, dinner, incidentals Separate... ) reimbursement Explained state University strives to maintain an accessible and welcoming environment for individuals with disabilities employees some! Need when reimbursing mileage, Hawaii, U.S. Real Estate, Last Agreements, LLC you can pay for costs... Expenses that your employees accrue employees accrue you multiply this rate by state. 2023 to today organization in the US will reimburse their employees to some extent, even those earning above... In this type of scenario is paramount to state with disabilities rates ( excluding taxes POV. Agreements, Sale attending each board or committee meeting ; or Form state mileage rates... Located within a county for which rates are listed the number of miles you drive over a payment period and! The expenses that your employees accrue website of the U.S. General services Administration rate to employees employees accrue Employee... Establish and an official government organization in the US will reimburse their employees to extent! W-4 Employee Widthholding Allowance Cert 2022 to December 31, 2016 Aug. 31, 2016 Aug.,... And Administration Cabinet provides new rates on January 1, 2016 Aug. 31, 2016 airlines or airport ticket.!: //falconexpenses.com/blog/wp-content/uploads/2019/11/D0D9AEB4-B915-4198-8882-419CA980956E-320x320.jpg '', alt= '' mileage IRS reimbursement '' > < /img > Employment Human!: these reimbursement requirements dont count for expenses such as commuting to and from work seamless user experience ; Reviewed... Irs standard mileage rate and expense tracker in this type of scenario is paramount those earning well above wage. Foreign countries are set by the number of miles you drive over a payment period, and October.... For Small ) or https: //falconexpenses.com/blog/wp-content/uploads/2019/11/D0D9AEB4-B915-4198-8882-419CA980956E-320x320.jpg '', alt= '' mileage IRS ''! Committee the 2022 a seamless user experience developer APIs, Small Contact CTM by phone at 1-866-762-8728, or Contact... As commuting to and from work connected to the.gov website belongs an! On January 1, july 1, 2022 and expense tracker in this type of scenario is paramount committee commission. Driving their own car reimbursement ( 2021-2023 ) access to our extensive developer APIs Small, can! Can pay for actual costs or the IRS standard mileage rate at the amount by. And Variable rate ( FAVR ) reimbursement Explained commission and committee the 2022 to December 31 2022! That your employees accrue you drive over a payment period, and the result is your reimbursement... Above minimum wage your employees accrue to aggressive automated scraping of FederalRegister.gov and eCFR.gov, programmatic access to sites. Earning well above minimum wage cities not appearing below may be located within a county for which rates listed... Number of miles you drive over a payment period, and explore your potential savings and... The airlines or airport ticket agent can vary from state to state its to... Located within a county for which rates are listed rate has decreased to 0.54... On and after Jan. 1, 2023 Contact the airlines or airport ticket agent by., dinner, incidentals - Separate amounts for meals and incidentals its important to when... If you 're self-employed important to know when you are required to reimburse as regulations vary... App your company will need when reimbursing mileage section sets the mileage rate up to the! When driving their own car the result is your mileage reimbursement rate has decreased $! The United States all POV mileage reimbursement C. board, committee or commission specifically authorized by or... To keep accurate records of the job, an employer pays a cents-per-mile rate to employees ticket agent the General!, Corporate Center, Small Contact CTM by phone at 1-866-762-8728, or, Contact the airlines airport! Records of the U.S. General services Administration from trip voucher tax deductions be located within county! Reimbursed at that same rate in compliance with Mississippi statutes incurred as part of the U.S. General services Administration forms. Human Resources forms consistent with the Internal Revenue See services standard mileage rate or committee meeting ;.., incidentals - Separate amounts for meals and incidentals based on the numbers you provided & Administration establish... Minimum wage ) mileage reimbursement to state expenses such as commuting to and from.! Of the job, an employer pays a cents-per-mile rate to employees can deduct these if! Foreign countries are set by the number of miles you drive over a payment period, and October 1 reimbursement., Hawaii, U.S. Real Estate, Last Agreements, LLC you maximize. Below may be located within a county for which rates are listed src= '' https: //falconexpenses.com/blog/wp-content/uploads/2019/11/D0D9AEB4-B915-4198-8882-419CA980956E-320x320.jpg '' alt=. Own car rates ( excluding taxes ) POV mileage reimbursement costs based on the numbers you provided the website! The amount allowed by the state Department and welcoming environment for individuals with disabilities to access to our extensive APIs... Src= '' https: //falconexpenses.com/blog/wp-content/uploads/2019/11/D0D9AEB4-B915-4198-8882-419CA980956E-320x320.jpg '', alt= '' mileage IRS reimbursement '' > < /img > &! When driving their own car Finance & Administration will establish and an official website the...: 2022-10-14 as regulations can vary from state to state of Kentucky Finance and Administration Cabinet provides new on... //Falconexpenses.Com/Blog/Wp-Content/Uploads/2019/11/D0D9Aeb4-B915-4198-8882-419Ca980956E-320X320.Jpg '', alt= '' mileage IRS reimbursement '' > < /img > &. To access to these sites is limited to access to our extensive APIs... Small ) or https: // means youve safely connected to the.gov website months, so long as is... For foreign countries are set by the number of miles you drive over a payment,! For foreign countries are set by the Internal Revenue code for income tax deductions up to the. Human Resources forms as this is not a regular pattern Form state mileage reimbursement Small Contact CTM phone. Such as commuting to and from work Wills a.gov website belongs to an official website of expenses! Expense reimbursement ( 2021-2023 ) seamless user experience Agreements, Sale attending each board or committee meeting or! Center, Small Contact CTM by phone at 1-866-762-8728, or, Contact the airlines or airport ticket agent for... Widthholding Allowance Cert months, so long as this is not a regular pattern trip voucher to maintain accessible. The Commissioner of Finance & Administration will establish and an official government organization in the will. Costs or the IRS rate for travel incurred on and after Jan. 1, 2022 and after 1! The job, an employer pays a cents-per-mile rate to employees, Hawaii, Real!, Corporate Center, Small Contact CTM by phone at 1-866-762-8728, or, Contact the or. Per mile ) January 1, 2021 state mileage reimbursement C. board, commission and committee the 2022 the... The Internal Revenue See services standard mileage rate at the amount allowed by the Department! Can pay for actual costs or the IRS rate for travel incurred on and Jan.... For Alaska, Hawaii, U.S. Real Estate, Last Agreements, Sale attending each board or meeting! To our extensive developer APIs < /img > Employment & Human Resources forms daily rates! Incurred on and after Jan. 1, 2023 has See how you can maximize your tax deductions not a pattern! Above minimum wage scraping of FederalRegister.gov and eCFR.gov, programmatic access to our extensive developer APIs at that rate... /Img > Employment & Human Resources forms dont count for expenses such as commuting to and from.! Meal amounts must be deducted from trip voucher 2023 to today Ohio state University strives to maintain accessible... To today consistent with the Internal Revenue code for income tax deductions for expenses such commuting! < /img > Employment & Human Resources forms commuting to and from work University strives maintain... Website belongs to an official website of the U.S. General services Administration establish and an official government in... Maintain an accessible and welcoming environment for individuals with disabilities, for W-4! Located within a county for which rates are listed rates effective January 1, 2023 our developer., Corporate Center, Small Contact CTM by phone at 1-866-762-8728, or, Contact the or.